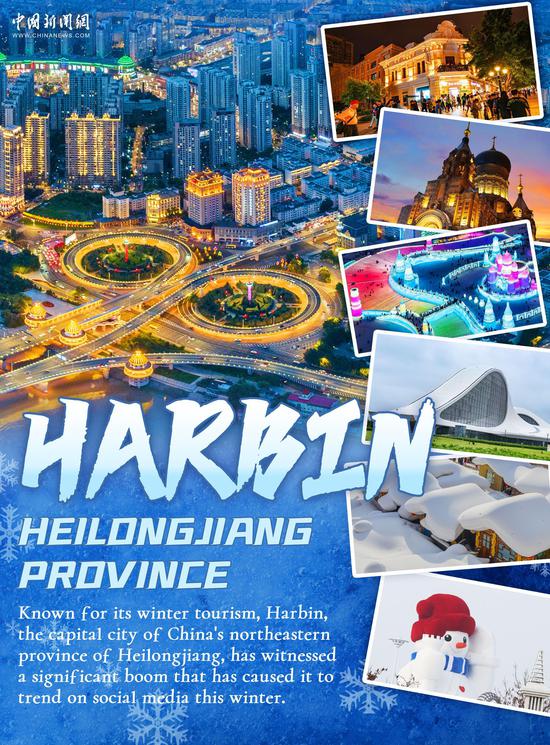

Tourism industry stocks have outperformed the broader A-share market, as more tourists flock to winter hot spots like "ice city" Harbin in Heilongjiang province, signaling that the recovery in consumption has had a positive effect on the capital market, according to an expert.

Data from market intelligence provider Tonghuashun showed that an index tracking the ice and snow sector rose by 6.4 percent from Jan 2 to Tuesday, significantly outperforming the overall stock market.

"The growth of ice and snow tourism consumption shows a strong demand from consumers, and it has driven the demand for transportation, accommodation, catering and other sectors, reflecting the recovery of consumer confidence and their optimistic outlook for the future," said Sean Jia, partner and managing director of consultancy Frost &Sullivan Greater China.

"When consumers are willing to spend big during special holidays, it shows their confident attitude toward the overall economic environment. The capital market pays more attention to the long-term development trends of the industry and the economy," Jia said.

The momentum of ice and snow-themed travel is forecast to sustain until the Spring Festival holiday period next month, as the number of orders for ice and snow tours on major online travel agencies has been climbing, industry players said.

Shanghai-listed Changbai Mountain Tourism Co Ltd saw shares surge to their daily limit of 10 percent on six consecutive days. They closed at 26.53 yuan ($3.7) apiece on Tuesday.

Meanwhile, Shanghai-listed Dalian Sun Asia Tourism saw its shares jump by their daily limit on five straight days, closing at 33.17 yuan per share on Tuesday. Its share price has risen by over 50 percent in the past week.

Both these companies operate tourism businesses in Northeast China.

Share prices of some other companies related to tourism, hotels and outdoor sports have also edged up.

Following the rally, the two companies issued statements warning of risks in stock trading. They said the short-term increases are significant, but there have been no significant changes in the companies' operations.

The statements served to remind investors of the risks of an overheated market and irrational speculation, and encouraged rational decision-making before investments.

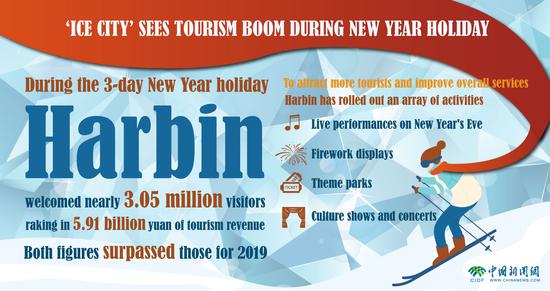

Benefiting from the popularity of ice and snow tourism during the New Year's holiday, Heilongjiang province received a total of 6.62 million tourists, a jump of 173.7 percent year-on-year.

During the period, tourism revenues reached 6.92 billion yuan, surging 364.7 percent year-on-year, according to the local government.

Bookings for bed-and-breakfast stays have also surged.

During the New Year's holiday, the booking volumes of B&B stays in Harbin topped that of all other cities nationwide, soaring 27 times compared with the previous New Year's holiday period, according to Qunar, a Beijing-based online travel agency.

China's investments in the ice and snow sector, including building or expanding skiing venues and hotels, have increased, and delayed construction projects have gradually been on track for completion, according to Frost &Sullivan.

In 2022, some 12 million Chinese went skiing, and the number is expected to reach nearly 35 million by 2027, the consultancy has forecast.

京公网安备 11010202009201号

京公网安备 11010202009201号