Tourists gather at the downtown area of Shanghai. (WANG GANG/FOR CHINA DAILY)

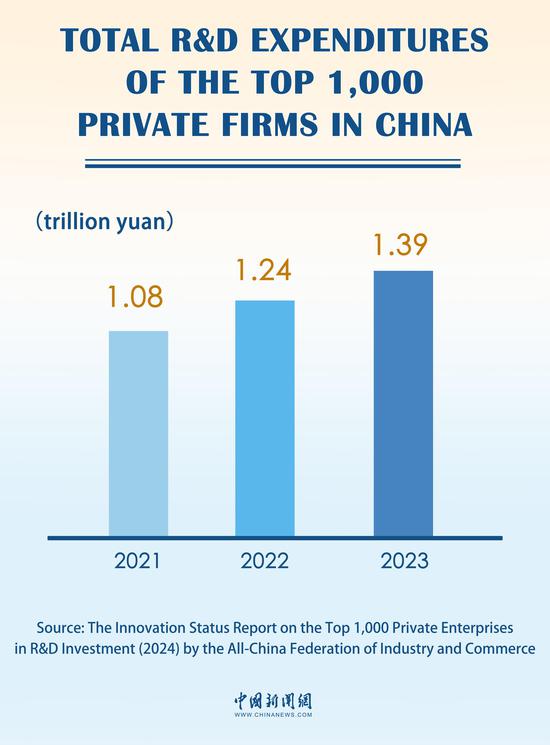

China is expected to further ramp up reforms to bolster the country's financial strength this year, a move of critical strategic importance in fueling homegrown technological innovation amid uncertainties regarding the United States' investment policy, according to officials and economists.

They said that specific measures to be taken this year include incentivizing State-owned capital investment in tech-heavy, early-stage companies, accommodating more long-term investment in the A-share market and possibly the further consolidation of financial institutions.

"No matter how the U.S. administration uses trade tariffs or financial instruments to put pressure on China, it ultimately pushes us to focus on strengthening our own capabilities," Tian Xuan, head of Tsinghua University's National Institute of Financial Research, said in an exclusive interview with China Daily.

"The key is to further improve the ground for innovation, with the capital market playing a crucial role in this," said Tian, who is also a deputy to the 14th National People's Congress, the nation's top legislature.

His words came amid increased uncertainty over U.S. policy moves on cross-border investment with regard to China.

On Wednesday, U.S. President Donald Trump said that "we'll invest in China", while expressing hopes for China to invest in the U.S.. This contrasted with the "America First Investment Policy" memorandum he signed last week, which outlined new or expanded restrictions on U.S. outbound investment in China in sectors such as semiconductors, artificial intelligence and quantum while restricting Chinese investment in crucial sectors in the U.S..

Feng Jianlin, chief economist at Beijing FOST Economic Consulting, said, "We need to prepare for an increasingly complex and challenging environment, with Washington's plans to further restrict U.S.-China investment serving as another warning.

"As U.S.-China competition intensifies, China must rely on self-sufficiency and make an all-out effort to drive technological innovation," said Feng, adding that he expects China to enhance support for the listing of high-quality tech enterprises and their mergers and acquisitions.

Earlier this week, Wu Qing, chairman of the China Securities Regulatory Commission, emphasized the need to integrate the capital market into the national system of mobilizing resources for sci-tech innovation, which analysts see as a preview of the policy tone on the capital market that will likely be unveiled at the annual meeting of the NPC in March.

In an article published in a journal supervised by the Ministry of Industry and Information Technology, Wu said that the capital market can convert short-term money into long-term investments, and vowed to boost support for key industries such as integrated circuits and medical equipment.

Specifically, Tian, from Tsinghua University, said it is important to deepen reforms in the primary market to encourage investment by State-backed institutions in tech-driven startups, extending evaluation periods for their investment performance and enhancing tolerance of their investment failures.

"With the U.S. administration intensifying restrictions on investments in Chinese companies, State-backed investment funds and State-owned enterprises are increasingly filling the gap left by the exit of U.S. venture capital," Tian said.

At a symposium on Wednesday with financial asset investment companies, which are mainly subsidiaries of State-owned commercial banks, the National Financial Regulatory Administration emphasized the importance of an ongoing pilot program of those companies making equity investments in terms of boosting technological innovation and serving private enterprises.

As part of China's efforts to attract foreign long-term capital, the State Council, China's Cabinet, released a plan this month outlining measures to encourage foreign investors' strategic shareholdings in Chinese listed companies and facilitate the establishment and financing of foreign investment companies in China.

Pan Yuanyuan, deputy director of the international investment department at the Chinese Academy of Social Sciences' Institute of World Economics and Politics, said these policy efforts coincide with global investors' ongoing reassessment of Chinese companies' valuations, which may work together in driving the recovery of foreign equity investment in China this year.

京公网安备 11010202009201号

京公网安备 11010202009201号