China's central bank on Tuesday cut its benchmark mortgage reference rate by 25 basis points (bps), the largest one-time rate reduction in years, in a renewed effort to stimulate credit demand and revive the property market.

The operation at the start of the year marks an early effort to stabilize a good start for the Chinese economy. This move is likely to boost urban housing sales, reduce long-term borrowing costs for businesses and consumers, and reactivate overall economic growth, experts said.

The five-year-plus loan prime rate (LPR), on which many lenders base their mortgage rates, was lowered by 25 bps to 3.95 percent, according to the National Interbank Funding Center. The one-year LPR remained unchanged at 3.45 percent.

Tuesday's cut was widely anticipated. However the extent exceeded market expectations, analysts said, noting that the cut of 25 bps was the largest one-time cut in history.

The move demonstrated a proactive implementation of monetary policy and increased support from the financial sector for the real economy, Wen Bin, chief economist of China Minsheng Bank, told the Global Times on Tuesday.

"Lowering the five-year-plus LPR will greatly promote investment and consumption, and support the steady and healthy development of the real estate market," Wen said.

As the property sector has yet to completely stabilize, the bigger-than-expected LPR cut sent a positive signal.

For a 30-year mortgage loan of 1 million yuan ($138,998.9), the monthly repayment to the lender will be reduced by about 150 yuan after this rate cut, Yan Yuejin, research director at Shanghai-based E-house China R&D Institute, said in a note sent to the Global Times on Tuesday.

"It will stimulate market demand for mortgage loans and housing consumption," Yan said.

Several banks in Shanghai and Beijing lowered mortgage rates in a swift response on Tuesday. The Shanghai branches of Bank of Communications and China Merchants Bank lowered the interest rate for first-home mortgages to 3.85 percent, while the interest rate for second-home mortgages was set at 4.25 percent, the Shanghai Securities News reported. The first-home mortgage rate in Beijing has been adjusted to as low as 3.95 percent, multiple media outlets reported.

Yan also noted that while previous LPR cuts were generally in the range of 5-15 bps, a one-time cut of 25 bps could be considered a massive monetary policy loosening measure.

The last LPR adjustment came in August 2023 when the one-year LPR was cut by 10 bps and the five-year-plus rate was left flat at 4.2 percent.

The one-year LPR remained unchanged this time. The asymmetric cut will help domestic monetary policy be more centered on the country's own needs and increase its policy autonomy against external shocks brought by the China-US interest rate differential, Wen said.

The LPR cut on Tuesday came after the central bank recently adopted multiple measures to support the economic recovery and boost confidence.

The reserve requirement ratio (RRR), the amount of cash that banks must hold as reserves, was cut by 50 bps from February 5, providing the market with approximately 1 trillion yuan of long-term liquidity. The re-lending and re-discount interest rates for the rural sector and small businesses were also reduced by 25 bps.

Another 500 billion yuan of funds was pumped into the market through the medium-term lending facility.

The move marks China's continued efforts to steadily reduce overall social financing costs, as highlighted in a number of key meetings including the Central Economic Work Conference in December 2023, Wu Chaoming, deputy head of the Chasing Research Institute, told the Global Times on Tuesday.

The tone-setting meeting urged efforts to ensure that overall financing costs steadily drop and keep the yuan exchange rate basically stable at a reasonable and balanced level.

It is expected that monetary easing will continue to be the main tone of policy, Wu said. "The larger than expected cut of the five-year-plus LPR also opened up room for a cut in the one-year tenor in the coming months," Wu said.

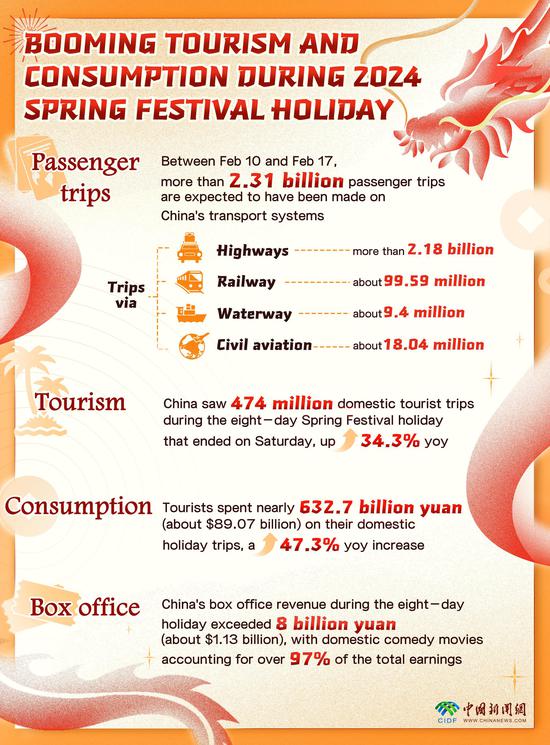

The economy has maintained its upward trend since the beginning of the year with robust consumption during the Spring Festival holidays and a bullish start for the A-share market.

As the Chinese economy is in a critical stage of recovery, the central bank may further guide market interest rates lower through interest rate cuts, RRR cuts and structural tools to provide additional impetus for consumption and an investment recovery, Zhou Maohua, a macroeconomic analyst at China Everbright Bank, told the Global Times on Tuesday.

京公网安备 11010202009201号

京公网安备 11010202009201号