The reform and opening up of China's finance have achieved great results.

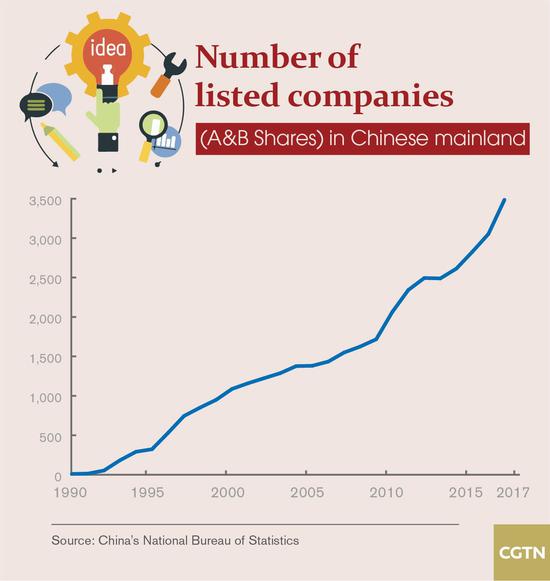

The landscape of finance in China has become more diversified thanks to the reform and opening-up policy. Before 1990, commercial banks played a major role in financial business while the financial disintermediation started as the establishment of the Shanghai and Shenzhen stock exchanges in 1990.

The number of listed companies including A and B shares in the Chinese mainland rose to 3,485 in 2017 from 10 in 1990 with a proportion of negotiable market capitalization in the total market capitalization on securities rising rapidly due to the reform of non-tradable shares in 2005. After 2010, technology has influenced finance more than ever, like fintech, which speeds up the financial disintermediation, especially in payments.

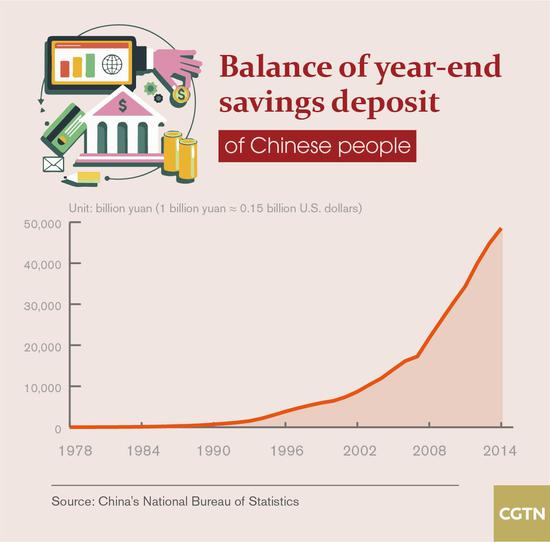

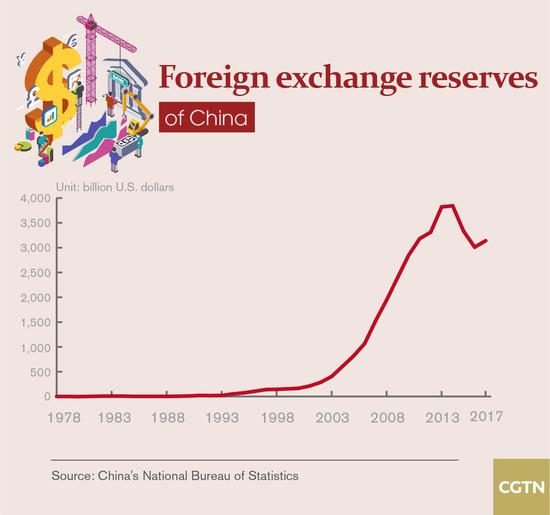

Financial assets in China have expanded significantly in the last 40 years. According to the data from China's National Bureau of Statistics (NBS), the country's balance of year-end savings deposits of urban and rural households increased to 48.5 trillion yuan (about 7 trillion U.S. dollars) in 2015 from 21 billion yuan in 1978. The volume of China's foreign exchange reserves surpassed 3.1 trillion U.S. dollars in 2017 compared with 167 million U.S. dollars in 1978, and the amount and the proportion of securitized financial assets have been continuously climbing.

China's regulation on finance was created by the People's Bank of China (PBOC) from 1983 to 1992. It specialized in replacing the integrated regulations of the PBOC with the China Securities Regulatory Commission (CSRC), which was founded in 1992 and was improved by the establishment of the China Banking Regulatory Commission (CBRC) in 2003. This year, finance regulations went further due to macro-prudential regulations created by the PBOC and micro-prudential responsibilities toward the CSRC as well as the China Banking and Insurance Regulatory Commission (CBIRC).

China has also made great progress in the market-oriented reform of the RMB exchange rate system.

In 1994, China unified the dual-track exchange rate system, which used to offer two different foreign exchange prices of the RMB and has been implementing a floating exchange rate system.

On August 11, 2015, China took a step further by considering the previous day's trading in the establishment of the currency rate, reflecting the currency rate would be determined by the demand and supply conditions in the foreign exchange markets and the movement of major currencies.

China then widened its RMB daily floating band to ±1 percent from ±0.5 percent in 2012. With these changes, the country was as seen moving its policy toward a more floating currency rate.

Meanwhile, the RMB inclusion in the SDR on November 30, 2015, was regarded as an important milestone in the integration of the Chinese economy into a global financial system as well as the recognition of China's achievements in its reform of monetary and financial systems.

In addition, China has made efforts to further reduce unnecessary restrictions and improve the policy framework on cross-border use of currency, including easing restrictions on QFII and RQFII programs for foreign institutional investors, making active preparations for a Shanghai-London stock connect program with experience from the Shanghai-Hong Kong and Shenzhen-Hong Kong stock connects.