U.S. sits on ticking bomb as debt reaches new high

(ECNS) -- America’s national debt has crossed $38 trillion — the highest in U.S. history. Since November last year, the debt has been climbing at a pace that no one has expected. Less than a year ago, it stood at $36 trillion. By the end of August this year, it had hit $37 trillion.

The soaring U.S. national debt has reached such alarming levels that many people pin their hopes merely on timely interest payments. Yet the harsh reality is, even these interest payments have now become a crushing burden for the U.S. government.

Estimates show that by 2025, interest payments alone will hit $1.4 trillion, more than a quarter of all federal income. This means that the U.S. treasury department has to pay over $100 billion per month, or about $2 million every minute, just to satisfy creditors.

This expanding "interest bomb" is severely constraining the U.S. federal government's fiscal capacity, with mandatory spending on Social Security, Medicare, and interest payments now swallowing 73% of total federal expenditures.

“We spent $4 trillion on interest over the last decade, but will spend $14 trillion in the next ten years. Interest costs crowd out important public and private investments in our future, harming the economy for every American,” Michael Peterson of the Peterson Foundation warned.

Given the profound impact of U.S. financial markets worldwide, a potential U.S. government default could trigger catastrophic turbulence, not just domestically, but across worldwide financial systems.

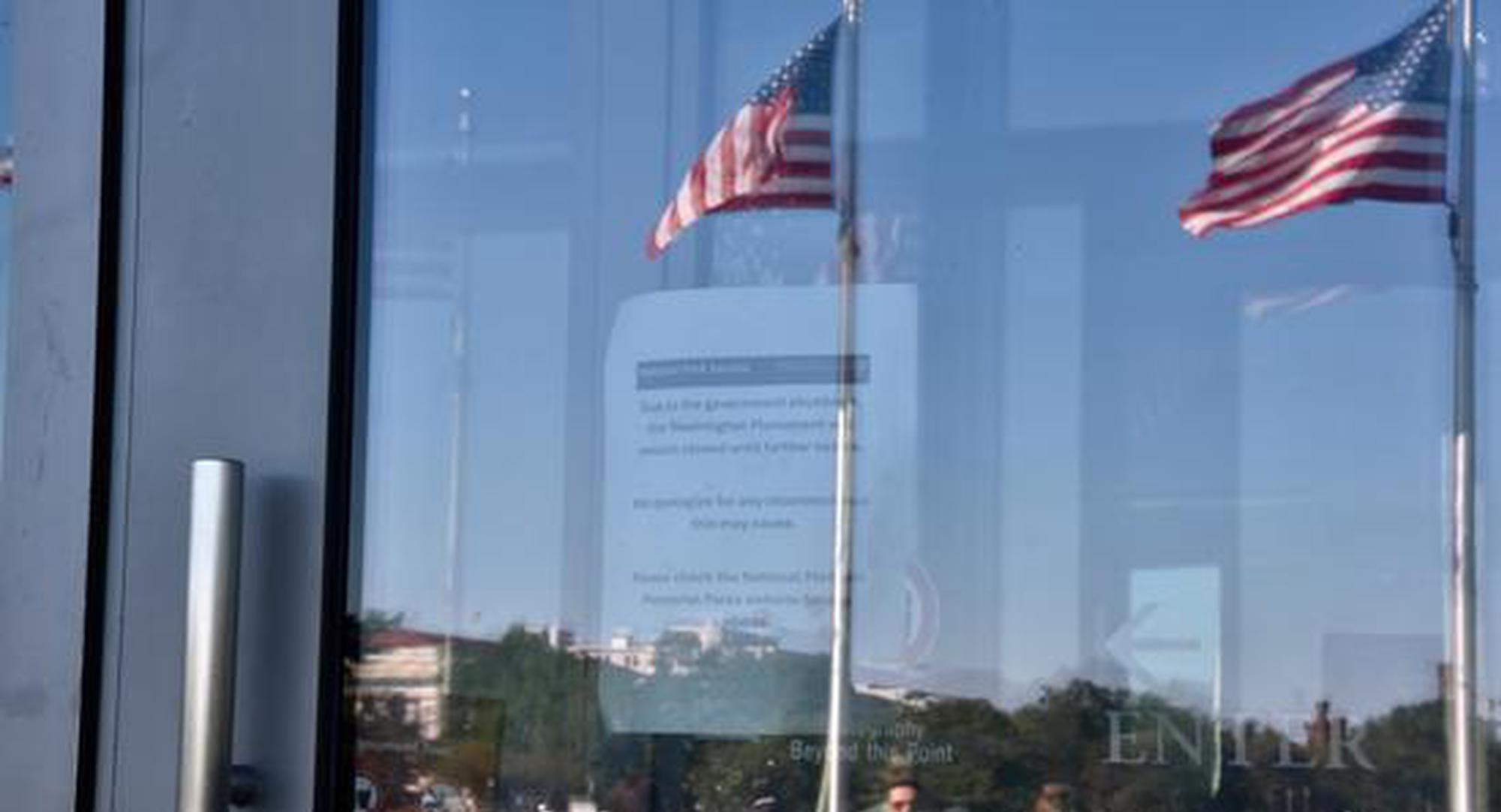

The U.S. government faces a dual crisis: functional insolvency coupled with relentlessly expanding debt. Rather than addressing fundamental issues, Washington is worsening the situation through political interference — such as imposing arbitrary tariffs, undermining Federal Reserve independence, and repeatedly forcing government shutdowns. These actions not only fail to contain the debt crisis but are worsening it.

“The reality is that we’re becoming distressingly numb to our own dysfunction. We fail to pass budgets, we blow past deadlines, we ignore fiscal safeguards, and we haggle over fractions of a budget while leaving the largest drivers untouched. Social Security and Medicare, for example, are just seven years from having their trust funds depleted – and you don’t hear anything from our political leaders on how to avoid such a disaster,” Committee for a Responsible Federal Budget President Maya MacGuineas said in a statement.

The critique lays bare America's fiscal predicament, that is, political numbness toward systemic failures has become normalized.

While both parties remain deadlocked in partisan disputes over budgetary deals, they persistently avoid addressing the root cause of debt expansion.

The U.S. is stuck in a perpetual cycle of issuing new debt to service existing obligations—a spiral with no exit in sight. This relentless accumulation suggests the national debt bomb is destined to keep growing.

(By Zhang Dongfang)