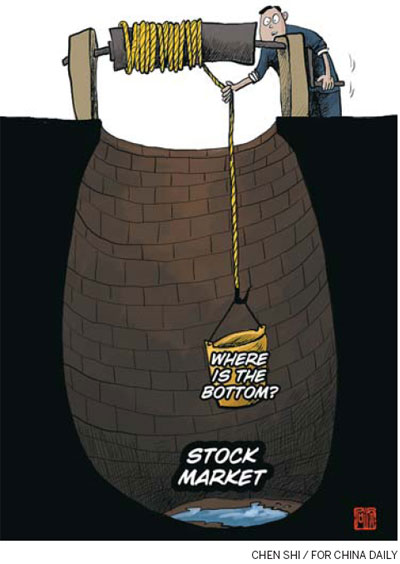

In 2011, the whole stock market is stumbling and individual shares are also going through dramatic fluctuations.

(Ecns.cn)--China's Shanghai Stock Exchange composite index (SSE Composite) plunged to 2,200 points recently and lingered near that figure for a few days. This new low point is close to the SSE Composite seen on June 14, of 2001-2,245 points. Looking at how the two indexes echoed each other across ten years, it seems the Chinese stock market has come full circle over one decade.

Some ordinary Chinese shareholders say: if you hold stocks for ten years, then you earn nothing or even go broke. And professional investors have similar feelings. "The SSE composite slid to the position it held ten years ago. Over this decade, we just played a game of ups and downs", says Lin Yixiang, the chairman of Tianxiang Investment concluded on a microblog on December 13, reports Securities Times.

Investors needed to go beyond the fluctuating index on the surface and conduct a reasonable, objective analysis on the phenomenon, some experts suggest, as quoted by the People's Daily on December 26.

The SSE Composite Index includes all stocks that are traded on the Shanghai Stock Exchange. It is the most commonly used indicator of SSE's market performance. According to People's Daily, some expert analyzes the state-owned enterprises (SOE) entered the stock market with a high stock price and were selected as samples of the composite index. To some extent, these shares affect the long-term trend of the SSE Composite Index.

Data shows the majority of shares that got listed on the Shanghai stock market in 2006 and 2007 were from SOEs. At the time, the stock market was booming. The SOE stocks were listed high to start with, and investors pumped up the prices even higher. In today's bear market, those stock prices have shrunk to one half, or even to one tenth of their original price.

Many netizens soberly pointed out: after so many changes in the stock market, there is no comparison between the index today and that of ten years ago. But still, negative public opinion reflects investors' dissatisfaction with the weak performance of the bear market, according to Securities Times on December 16.

"To preserve or increase the value of money, you had better not depend on the stock market", says Cao Wei on December 15, a professional investor who has devoted fifteen years to the Chinese stock market, reports Zhejaing Online, "In 2011, the whole stock market is stumbling and individual shares are also going through dramatic fluctuations. At the moment, it is not an ideal financing arena for small and medium investors."

A survey on China's stock market was conducted on Tencent.com and about 300,000 netizens answered the questionnaire online by December 14. About 80 percent of interviewees thought the Chinese stock market weak and behaving abnormally. And seventy five percent agreed that the major contribution to instability is related to the supervision mechanism and polices.

The inherent bug within the supervision system is the underlying cause of China's lingering bear market, insists Liu Jipeng, the director of Capital Research Center of China University of Political Science and Law, reports Economic Information on December 26.

Liu argues while experiencing the subprime crisis and financing crisis, the capital markets of Europe and the U.S. maintained steady operation while in turbulence. But China, which kept its robust growth despite the world-wide economic crises in 2008 and 2011, is frustrating gloomy stock market investors.

Liu points out people usually see currency policies influence the stock market, but neglect of the defects that exist in the supervision system is the real trigger of a weak stock market. He emphasizes securities regulators need to spend more energy to protect small and medium size shareholders, who are the foundation of capital markets. Now they are powerless to compete against big shareholders and avoid too much pressure and risk.

It is time to propose a question - who does the Chinese stock market serve? Looking at over two decades of development, the Chinese stock market appears orientated to particular issues, such as promoting reforms of SOEs, serving as the financing platform for small and medium enterprises and high-tech enterprises. It is not wrong to offer such special financing services, but how about the public investors? For the stock market, the core service targets should be public investors, but to some extent their demands are neglected.

Copyright ©1999-2011 Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.