(ECNS) -- China's online market for fast-moving consumer goods (FMCG) has grown astonishingly in the past four years and is still expanding at a triumphant pace, global consulting agency OC&C observed in its latest report.

The report released on Wednesday says China's online FMCG market has risen to more than $25.3 billion from just $1.4 billion in 2010, surpassing the United States and UK.

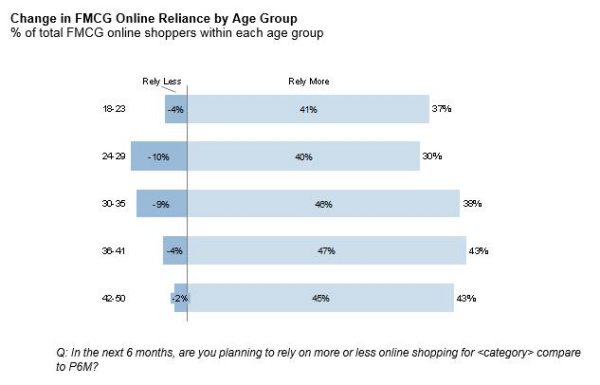

Transaction volume has grown with the maturing of customer e-shopping lifestyles. Sampling 4,600 respondents in 16 Chinese cities, OC&C found that not only post 80s and 90s generations that grow up with the Internet are resorting to familiar shopping habits, but that around 40 percent of respondents aged 30 to 50 are also demonstrating a willingness to spend more online for their daily necessities.

"Price and convenience-related factors are consistently placed as the top reasons for buying FMCG online in China," says Jack Chuang, a partner at OC&C in Greater China."The growing middle class wants to save money on everyday consumables so they can use these savings towards a better lifestyle including for dining out or buying international fashion brands."

Despite the encouraging speed of expansion, China's online FMCG market is still under-developed compared to other online retail sectors, such as for clothes and electronic devices, the report says.

Leading platforms are eyeing the huge potential. In July, China's e-commerce giant Alibaba announced a billion-yuan level investment in its Tmall Supermarket, aiming to build China's largest online supermarket by 2018. JD.com is also partnering with Walmart to form an online and offline retail ally.

The report shows Alibaba is dominating the online FMCG field with a 52 percent share, while the market is more fragmented with multiple vertical specialists on the rise.

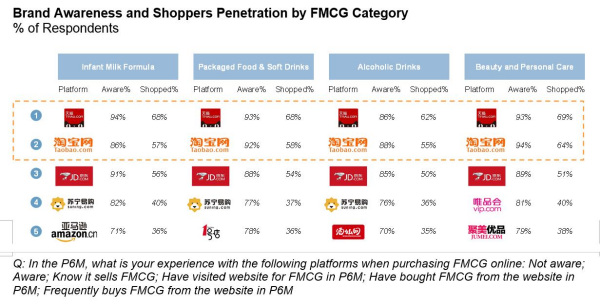

It found that Alibaba's platforms are not highly rated in terms of shopping experience, nor are they frequently ranked among the top five across selected FMCG categories.

However, when the survey asked about brand awareness and actual purchases, Tmall and Taobao, under Alibaba, showed the highest brand awareness and shopper penetration across major FMCG categories.

The report further explained that "familiarity" is the key reason behind customer choice for certain platforms. As an early entrant, Alibaba is able to keep customers with its familiar layout and process. Beyond that, it also provides competitive prices, a convenient one-stop shopping destination, as well as a ubiquitous payment system.

But the experience rating figure implies that companies can still seek opportunities in customized needs, Chuang says. "Customers are increasingly paying for value beyond usefulness in a product. Sometimes a store for all cannot offer the right things they want and they may seek other alternative vertical platforms."

Chuang says the increasing role of customer experience is calling for companies to run with more targeted strategies.

"Companies should treat e-commerce not only as a sales channel but also as a platform to build their brand," Chuang noted.

He added that brands could benefit when partnering with strategically aligned platforms, only if they understand the level of control and capability required to operate an online store either in-house or to rely solely on the platforms.