A file photo of a digital hongbao. An official said on Thursday that enterprises that hand out WeChat hongbaos to the general public through lucky draws should withhold the required portion of the bonus and remit it to tax authorities. (File photo)

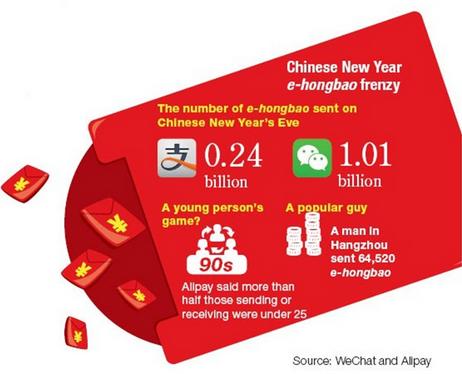

(ECNS) – Chinese internet giant Tencent's Weixin service, the popular messaging app also known as WeChat, stole the limelight this Chinese New Year by making the tradition of giving hongbaos, or cash gifts wrapped in red envelopes, even more popular in the digital era.

But, should the digital hongbaos also be subject to income tax?

According to a report by the official Xinhua News Agency, Wang Jun, head of the State Administration of Taxation, said in Beijing on Thursday that enterprises that hand out WeChat hongbaos to the general public through lucky draws should withhold the required portion of the bonus and remit it to tax authorities.

However, no tax should be levied on small-sum WeChat hongbaos exchanged between friends and relatives for the purpose of celebration or entertainment, he said.

WeChat's hongbao service saw explosive growth during the Spring Festival and sparked public debate about the taxation of such gifts.

Shanghaiers are pushing the envelope with e-hongbao

2015-02-26Over 100m people enjoy holiday hongbao

2015-02-25Guangdong woman collects 20,000 hongbao

2014-02-08E-hongbao proves a welcome respite from real thing

2014-02-04‘Tuhao‘ hangs thousands of Hongbao on trees

2014-01-29Hongbao places financial burden on New Year celebrations

2013-02-18Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.