(ECNS) – Government subsidies to listed companies, particularly the state-run ones, have come under fire for squandering the money of taxpayers.

As of April 10, 1,556 listed companies had unveiled their annual reports, of which 1,377 obtained government subsidies worth 77 billion yuan ($12 billion) in 2013.

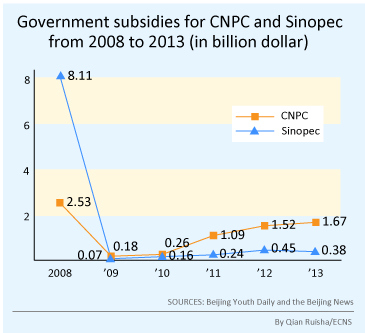

The crown belonged to China National Petroleum Corp (CNPC), which received 10.3 billion yuan ($1.7 billion). Along with Sino Petroleum Corp (Sinopec), the two state-owned oil giants received a total of 125 billion yuan ($20 billion) in government subsidies in 10 years.

The CNPC said the government extended subsidies to make up for the price inversion in refined and crude oil, and to support the supply of oil products to the domestic market.

But the two companies are not short of money.

In 2008, the year CNPC and Sinopec got the largest subsidies, their net profits were 113.8 billion yuan ($18 billion) and 28.4 billion yuan ($4.6 billion) respectively. In 2013, the figures rose to 129.6 billion yuan ($21 billion) and 67.2 billion yuan ($11 billion).

Unlike CNPC and Sinopec, some companies face the threat of delisting. Dubbed special treatment (*ST) companies, they have been in red ink for at least three years and rely on subsidies to stay listed. Available annual reports show that 23 *ST companies received a total of 1.5 billion yuan ($242 million) in government subsidies.

Baoshuo Co., Ltd., a company on the brink of delisting, recorded in its 2013 third-quarter report two inflows of city-level and county-level government subsidies totaling 607 million yuan ($100 million). The money was considered key to revoking the threat of delisting. On March 6, Baoshuo dropped "*ST" from its stock name.

For many companies that are losing money, the subsidies come just in time to polish their financial statements and make them look afloat.

In 2013, government subsidies to over 170 listed companies surpassed their real profits.

For example, China Eastern Airlines reported a net profit of 2.1 billion yuan ($350 million) in 2013, but only after the government subsidized it with 2.3 billion yuan, meaning the company was in fact losing 200 million yuan.

Experts say the government is using taxpayer money to save bad assets.

Under the current delisting policy, a company's net profit is the only indicator of whether its listing should be suspended. As a result, many companies scramble for subsidies to bring up their net profits.

A new policy would evaluate a listed company by looking at its net assets, and a delisting procedure would start if a company reports negative net assets for two years. The new policy is expected to come into effect at the end of this year.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.