Export-bound cars await loading at Yantai Port, Shandong province. (TANG KE/FOR CHINA DAILY)

Global shipping companies' recent reluctance to transit through the Suez Canal will affect China-Europe trade and exert pressure on operational costs of businesses on both sides, said experts and business executives on Tuesday.

Owing to security concerns related to their shipping operations in the Red Sea region, a key route for entering and exiting the Suez Canal, several shipping groups, such as Denmark's Maersk Line, Germany's Hapag-Lloyd AG and France's CMA CGM SA, have recently announced the suspension of voyages in the area along with adjustments to marine insurance policies.

When cargo ships avoid the Suez Canal and instead navigate around the southwestern tip of Africa — the Cape of Good Hope — it implies increased sailing costs, extended shipping durations and corresponding delays in delivery times.

Due to the necessity of circumnavigating the Cape of Good Hope for shipments heading toward Europe and the Mediterranean, current average one-way journeys to Europe are extended by 10 days. Meanwhile, journey times heading toward the Mediterranean are further increased, reaching around 17 to 18 additional days, said Southeast Shipping Agency Co, a Ningbo-based shipping agency.

As of Dec 18, in the global shipping market, rates for a 40-foot container have risen by around $600 on routes to the Middle East and Europe, settling at between $2,500 and $2,600. Meanwhile, on routes to Haifa, Israel, prices have already climbed, reaching around $6,000.

This will significantly inflate market freight rates between Chinese and European ports, said Wang Zhengcheng, a researcher of transportation at CIB Research Co Ltd, a Shanghai-based business think tank.

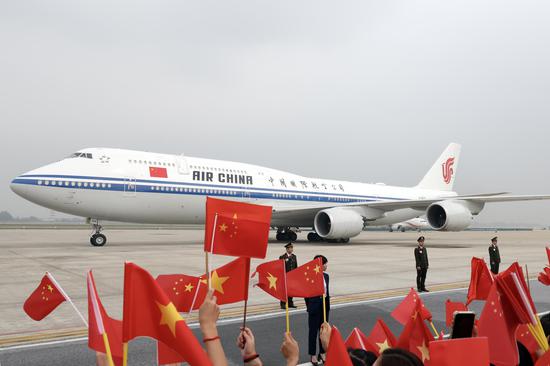

"If a vessel transporting Chinese automobiles opts to circumnavigate the Cape of Good Hope on its way to Europe, the duration of the journey will be extended by two weeks. Even if the charter fees stay constant, the export cost for each Chinese car to Europe will increase by 20 percent," said Wang, adding that additional expenses — including ship insurance premiums and security costs — will also experience significant increases.

Having received a number of phone calls since late last week, Wang Pinhe, a sales manager at Zhejiang Kingston Supply Chain Management Co — a Yiwu, Zhejiang province-based international logistics company — said many ports in the Red Sea have temporarily become inaccessible, with shipping companies notifying clients that they cannot proceed as originally planned.

Prices between ports in Zhejiang and the Middle East have surged from over $2,000 to over $3,000 this week. They are expected to rise to $4,000 soon, Wang added.

Prices for shipping along Middle Eastern, European and Mediterranean routes are expected to continue rising in January. Moreover, shipping companies are highly likely to initiate discussions for renegotiating export shipping rates on the afore mentioned routes, said Yan Hai, chief researcher of the transport sector at Shanghai-based Shenwan Yuanhong Securities.

The high maritime freight rates between China and Europe will push companies on both sides to opt for China-Europe freight train services in the next phase, especially for high-end industrial parts and goods, said Feng Hao, a researcher at the National Development and Reform Commission's Institute of Comprehensive Transportation.

Maersk Line has decided that due to safety considerations, all vessels previously paused and due to sail through the region, will now be rerouted around Africa via the Cape of Good Hope, the Danish company said in a statement on Tuesday.

京公网安备 11010202009201号

京公网安备 11010202009201号