U.S. chipmaker Broadcom Inc announced that its $61 billion acquisition of cloud computing company VMware closed on Wednesday, having received all required regulatory approvals from global regulators, after China's market regulator approved the merger on Tuesday with restrictive conditions.

Broadcom is paying $61 billion in cash and stock for VMware and taking on $8 billion of its debt, making this one of the biggest technology deals ever, the Associated Press reported.

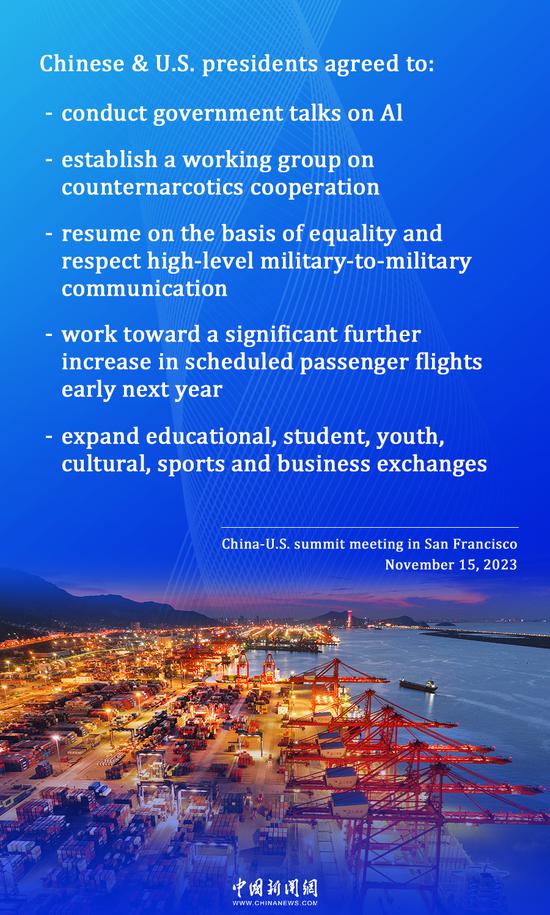

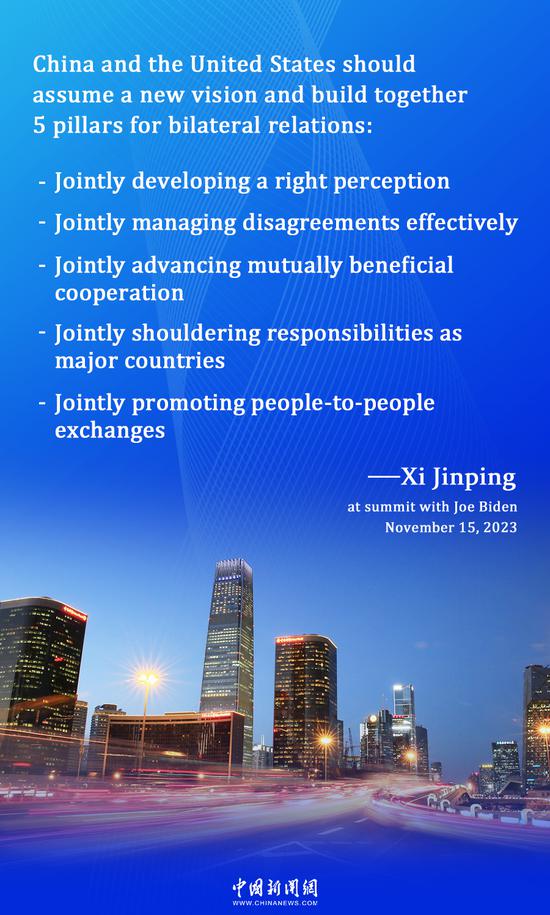

Some Western media outlets linked the approval to the meeting between the Chinese and U.S. top leaders in San Francisco last week, as it was reported last month that investors in both companies were concerned about the outcome of the deal, citing tensions that could lead Chinese regulators to scuttle the deal.

Chinese analysts had mixed views of the development, saying that it could be seen as an outcome of improved China-U.S. relations, but also that the improvement was a result of the long-term bilateral efforts.

China's State Administration for Market Regulation (SAMR) on Tuesday published a statement saying that it approved Broadcom's acquisition application with restrictive conditions according to China's Anti-Monopoly Law, as the SAMR believes that this merger has or may have the effect of excluding or restricting competition in the global and China markets for cloud virtualization software, storage adapters and ethernet network cards.

The conditions relate to the way the companies sell their products in the China market, including ensuring that VMware's server software and Broadcom's hardware can interoperate with their competitors.

According to the SAMR, in 2021, Broadcom's share in the global fiber channel adapter market was 60-65 percent and 70-75 percent in the China market, both ranking first, while the market share of major competitors was 35-40 percent in the global market and 25-30 percent in China.

Broadcom has a dominant market position, and the global and Chinese fiber channel adapter markets are highly concentrated, showing a duopoly market structure, said SAMR.

Effective and reasonable assessment of the risk of exclusion of competition caused by such large-scale M&As is very necessary, even more necessary than in traditional industrial fields, Zhou Mi, a senior research fellow with the Chinese Academy of International Trade and Economic Cooperation, told the Global Times on Wednesday.

"The Chinese market regulator has taken a long time to assess the issue, perhaps because cloud services are a relatively technologically advanced field with broad implications for the future," said Zhou.

The SAMR received the merger application on September 6, 2022. At present, the case is in the extended stage of further review, and the deadline is December 13, 2023.

According to other anti-monopoly review decisions published by the SAMR, it usually takes at least one year go through the review procedures.

Wang Peng, an associate researcher at the Beijing Academy of Social Sciences, told the Global Times on Wednesday that domestic regulatory cycles and processes are relatively standardized, and the process will not be affected by an event in a short timeframe.

"I think the timing of the announcement of the Broadcom acquisition deal after the China-U.S. summit was just a coincidence. China and the U.S. have reached some type of consensus through previous discussions and exchanges," said Wang.

Zhou also said that as closer communication and exchanges resume between China and the U.S., it will be helpful for both sides to communicate each other's concerns. Improved communication speeds up the time to reach agreement among interested parties.

京公网安备 11010202009201号

京公网安备 11010202009201号