Chinese oil and gas shares soared significantly on Monday, as prices soared in the wake of drone attacks on the world's biggest oil processing facility and an oilfield in Saudi Arabia.

Shares of energy equipment companies and oil and gas firms traded in Shanghai and Shenzhen jumped 3.96 and 2.96 percent respectively on Monday, according to Shanghai-based information provider Wind Info.

Brent Crude on Monday opened at $67.8 per barrel on the oil futures market, an over 10 percent surge from Sunday's close of $60.22. And crude prices once jumped nearly 20 percent during the trading day.

"The international economic growth momentum has been weakening this year," Fu Linghui, a spokesperson for the National Bureau of Statistics, said on Monday at a news conference held in Beijing.

"In August, the prices of major commodities fell from the previous month. International energy prices dropped by around 6 percent month-on-month, and the OPEC price also decreased from the previous month. I think the impact of the attacks on the global energy market still remains to be seen."

Commenting on the situation, Lin Boqiang, director of the China Centre for Energy Economics Research at Xiamen University, said oil prices could spike in the next few days as a result of the attack on oil facilities and an oilfield in Saudi Arabia and the impact of the attacks on the Abqaiq facility remains to be seen. The impact on global market depends on how high the oil price rises and how long the high price lasts.

"If the high price lasts for a short time, the impact could be modest. However, if the high price lasts longer, the impact will be huge for the current fragile global market and will lead to inflation in the United States," Lin said.

According to Lin, a $1 rise in international oil prices would cost Chinese consumers around an extra 3.5 billion yuan ($456 million) a year.

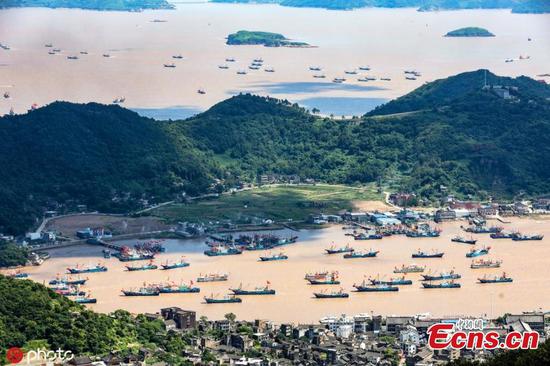

As one of the world's largest oil buyers, China imported 42.17 million metric tons of crude oil last month, rising 9.9 percent year-on-year.

"Any rise in international oil prices means that Chinese consumers have to pay a lot more money, as China's refined oil prices are strictly linked to the international markets," Lin added. "China, which is heavily reliant on imported oil, will be the biggest victim of the attacks on the oil facility in Saudi Arabia, a key oil exporter in the world."

Saudi Arabian Energy Minister Prince Abdulaziz bin Salman said on Sunday that the attacks have affected Saudi oil supply by 5.7 million barrels per day, or about 50 percent of the kingdom's daily oil production and 5 percent of the daily oil supply on the international market.

Lin said it is hard to estimate the future impacts of the attacks due to many factors, including the actual damage on the oil facility and oilfield and whether the US and International Energy Agency will successfully release oil from emergency oil reserves.

"We need to pay more attention to energy security, especially as the situation in the Middle East is fairly fragile," Lin added. "We need to be well-prepared in terms of oil reserves and find alternatives to reduce external reliance, such as encouraging people to take public transportation and purchase electric vehicles."