U.S. oil giant ExxonMobil Corp is planning to invest $10 billion in a chemical project in South China's Guangdong Province, and experts said it shows that U.S. heavyweights won't change their long-term business strategy despite the efforts by U.S. President Donald Trump to create trade friction between the two countries.

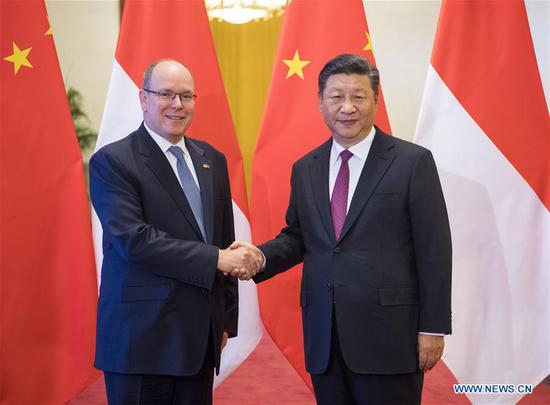

Chinese Premier Li Keqiang said during a meeting with ExxonMobil Chairman Darren Woods on Friday that ExxonMobil is "more than welcome" to carry out large investments in petrochemical engineering projects in China, according to a statement published on gov.cn on Friday.

On Wednesday, ExxonMobil Corp said that it had signed a cooperation framework agreement with the Guangdong provincial government to build a chemical complex in a local industrial park.

The project, which should start in 2023, is still currently "subject to a final investment decision," a statement from ExxonMobil said. The company didn't reply to requests for comment from the Global Times by press time.

ExxonMobil also said it intends to participate in the Huizhou LNG receiving terminal, a project that is currently underway in Guangdong.

Lin Boqiang, director of the China Center for Energy Economics Research at Xiamen University, said that the U.S. is increasingly eyeing the Chinese market for liquefied natural gas (LNG) exports and LNG infrastructure construction. This is partly because the local markets in the U.S. are increasingly saturated, and also because the Chinese government is pushing market-oriented reform in the natural gas sector, Lin said.

In February, U.S.-based Cheniere Energy Inc signed a deal to sell LNG to China National Petroleum Corp, which was the first long-term contract to import LNG to China from the U.S., according to domestic media reports.

Wider interest

Apart from energy cooperation, U.S. companies in other sectors are also mounting efforts to invest in the Chinese market, despite the two countries' deteriorating trade relations.

U.S. car manufacturer Tesla, for example, has increased the registered capital of its Shanghai subsidiary to 4.67 billion yuan ($683 million) from 100 million yuan, according to the National Enterprise Credit Information Publicity System. Tesla announced in July it would build an electric car manufacturing plant in Shanghai.

Investment in China by U.S. firms surged by 12 percent on a yearly basis from January to July, according to data released by the Ministry of Commerce (MOFCOM) on August 16.

Bai Ming, a research fellow at the Chinese Academy of International Trade and Economic Cooperation, said that this investment trend shows that China is more and more attractive to overseas firms, given the ample demand and improving business environment in the domestic market.

"U.S. companies are rational. They won't change their long-term business strategy just because of certain trade policies against China," Bai told the Global Times on Sunday.

Lin also noted that by setting up companies in China, U.S. companies can bypass tariff risks caused by the trade friction.

China is showing a welcoming attitude to investment from the U.S. and other countries as a signal that it will stick to the opening-up process, despite the trade tension, Lin noted.

"I don't think the trade dispute will fundamentally change the trend of trade between China and the U.S.; neither will it change the warming-up of investment between the two countries," he said.

A total of 35,239 foreign-invested companies were newly established in China in the first seven months of this year, up by 99.1 percent on a yearly basis, the MOFCOM data showed.