Cellphone-based third-party payment market gets crowded, goes mainstream

"Alipay or WeChat Pay?" she asked as soon as he finished his lunch.

"So you don't accept bank card? And cash isn't an option?" Chang Xiaohui, 27, an electrical engineer, counter-questioned the waitress at a Hong Kong-style restaurant in Shanghai.

She replied: "Sure we do. I mean, not many people are using bank cards or cash nowadays, right?"

"Right." With that, he paid with cash.

Chang had no other option because his smartphone was dead due to battery outage. He couldn't remember his bank card PIN either-it's been more than two months since he had used it for payments.

Chang is not an exception but the rule across China. Millions of consumers such as Chang simply love the convenience of mobile payments.

Cash and plastic cards are nearly out. Third-party mobile payment tools are in.

From street-side peddlers of roasted sweet potatoes to hypermarket checkout counters, ubiquitous quick response or QR code stickers or laminated labels plead you to "scan me to pay".

At a Shanghai wet market, If you pay for a kg of squid using WeChat, you can get up to 5 percent discount.

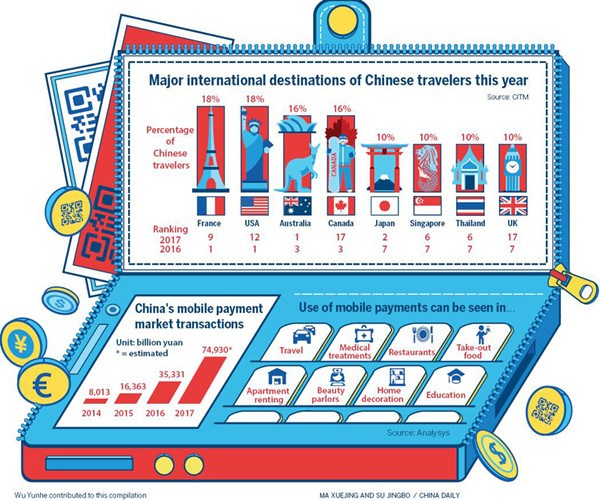

According to market research firm Analysys, China's third-party mobile payment providers accounted for transactions worth 18 trillion yuan ($2.66 trillion) in the first quarter of 2017, up about 47 percent quarter-on-quarter.

Analysys estimates China's mobile payment market will account for transactions worth 100 trillion yuan by 2019.

"Growth of mobile payment tools is faster than that of any other payment models. The trend indicates that mobile payments will become the mainstream payment model across China in the near future," said Zhou Yuedong, vice-president of the credit card division of ICBC, the country's largest lender.

This month, UnionPay, China's bankcard association and payment technologies provider, jumped on the mobile payment bandwagon. Its QR codes offer multiple payment modes, thus intensifying the already fierce competition in the market.

UnionPay users can scan QR codes at points of sale. Alternatively, sellers can scan their customers' UnionPay QR code. One-to-one transfers can be made, facilitating payments between individuals, individuals and businesses, and between businesses.

Cash withdrawals from ATMs via QR codes and similar innovative solutions will also be available in the future, according to UnionPay.

"Consumers may think UnionPay was too slow and trailing Alipay and WeChat Pay. But, UnionPay launched QR code-based payments only after the authorities officially approved such mobile payment systems," said Liu Fei, a retail sector researcher with Shanghai Mingshan Consulting.

Before launching its QR code-based payments, Union-Pay promoted its near field communication or NFC payments that enable customers to pay by merely tapping their smartphones. The embedded SIM card in the phone would forge a payment agreement with the point-of-sale without having to key in the PIN or sign on the bill.