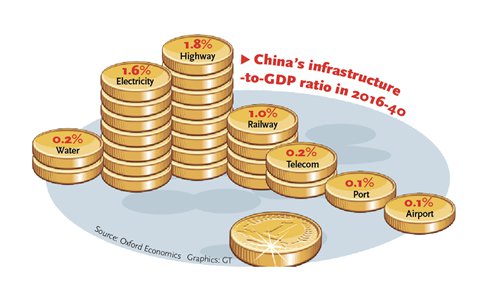

China's infrastructure-to-GDP ratio in 2016-40

Amid a world of opportunities, competition heats up: experts

China is the leading force in fulfilling a massive demand for global investment, particularly in Asia, and its internal need for infrastructure projects is also the largest in the world, according to a report released Tuesday by Global Infrastructure Hub (GIH), an organization under the Group of 20 nations, and Oxford Economics.

From 2007-15, China accounted for almost 30 percent of all global infrastructure investment, and the world's second-largest economy will need about $28 trillion in infrastructure projects from 2016-40, representing 30 percent of the global total, said the report.

The report estimated that the world will require $97 trillion in infrastructure investment by 2040, and the trends involving China will persist through that year, it said.

"While we expect the rate of infrastructure investment growth to moderate during the forecast period, in common with the pattern for overall investment within the Chinese economy, we expect China to maintain a similar share of global infrastructure investment," said the report, which was sent to the Global Times.

China's infrastructure investment is likely to exceed $26 trillion between 2016 and 2040, the report said. In terms of domestic trends, China's requirement for infrastructure investment will remain the world's largest from 2016-40, particularly in sectors such as roads and electricity.

These huge estimates are no surprise to Chinese experts, who pointed to an unprecedented wave of Chinese interest in overseas infrastructure projects.

"There are many estimates and analyses of future demand for infrastructure investment and the major role China plays in meeting that demand, but there is one common theme: The demand is huge and China is the leading force," Wang Jun, an expert at the China Center for International Economic Exchanges, a Beijing-based think tank, told the Global Times on Tuesday.

Through bilateral deals, mostly conducted by State-owned enterprises and bilateral platforms such as the China-proposed Asia Infrastructure Investment Bank (AIIB) and the Belt and Road initiative, China has placed an "unprecedented" focus on infrastructure projects both at home and abroad, Wang said.

In recent years, Chinese companies, under a "going-global" strategy, have been involved in many infrastructure projects overseas, from ports in Panama to roads in Africa to high-speed rail lines in Southeast Asia.

In the first half of 2016, despite a year-on-year fall of 30 percent in outbound foreign investment, Chinese companies signed overseas construction deals worth $123.78 billion, increasing 24.2 percent year-on-year, according to data released by the Ministry of Commerce on July 13. Most of the deals are in the transport and electricity sectors, the ministry said.

Among the new deals, 57.7 percent were in countries along the route of the Belt and Road initiative, it added.

The initiative, which aims to connect China to Europe and Africa through land and sea transport links, has focused on investment in infrastructure projects. China has pledged $269 billion to fund projects for the initiative.

Also, China-backed multilateral organizations such as the AIIB and the New Development Bank under the BRICS platform are targeting infrastructure investment in Asia and the BRICS countries, which in addition to China include Russia, Brazil, India and South Africa.

According to the GIH-Oxford report, infrastructure investment in Asia increased by more than 50 percent between 2007 and 2015, and China alone contributed more than half of this increase.

China's focus on overseas infrastructure projects meets the needs of the national economy and supports companies' strategies, according to Ma Hong, an analyst at China Capital Investment Group, who focuses on infrastructure.

"Through infrastructure, what China is really investing in is the future of its economy," Ma told the Global Times on Tuesday.

"By improving infrastructure in these countries, China hopes to improve trade and expand the market for domestic products and companies," he said.

For companies, which have accumulated resources and experience on a broad scale in the past two decades, infrastructure projects overseas offer a "buffer zone" for them as they go through a transformation and upgrading process, Ma said.