(Graphics/GT)

Analysts say Alipay, WeChat already well-entrenched

China UnionPay, the world's largest bank card group, is trying to make a splash in the country's mobile payment market with active promotion of its QR (quick response) payment solution, but it's likely to do little more than create a few ripples, experts said.

This week, domestic consumers can enjoy a 38 percent discount at about 100,000 mortar-and-brick stores across the country if they use UnionPay's QR payment system, called "Cloud Quick Pass QR Payment." The promotion is scheduled to last until Thursday.

The QR payment system was launched by the State-run card company in partnership with more than 40 domestic commercial banks in late May to offer a similar payment option to that of Alipay, a payment tool run by Alibaba's affiliate Ant Financial, and WeChat Pay developed by Tencent Holdings.

Nearly 600,000 merchants in China have accepted the system, according to a press release issued by UnionPay on May 27.

"UnionPay's QR payment service will attract some users with the promotion, but it's unsustainable," Li Chao, an industry analyst with Beijing-based market consultancy iResearch, told the Global Times Monday.

Most Chinese consumers have become accustomed to using Alipay and WeChat Pay. UnionPay, a latecomer that lacks distinctive competitiveness, will find it hard to change the situation, said Li.

A report released in mid-May by Analysys International, another Beijing-based market research firm, showed that Alipay continued to lead China's third-party mobile payment market in the first quarter of this year with a 53.7 percent share, while Tencent mobile payment services ranked No.2 with a 39.5 percent share.

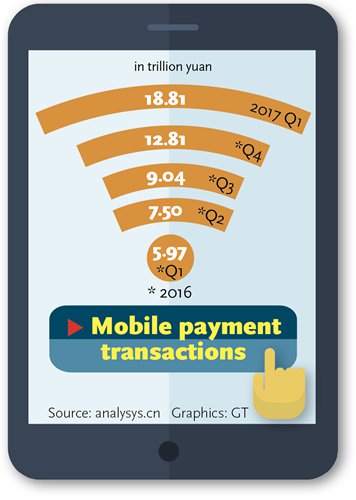

China's mobile payment transactions hit 18.8 trillion yuan ($2.8 trillion) during the first quarter, up 215 percent year-on-year, said the report.

The mobile payment sector in China is expected to become even more competitive after July 16 when U.S. payment service providers will gain full market access in the electronic payment sector.

"We look forward to cooperating with the relevant Chinese authorities to gain full market access in due course," Dennis Chang, division president of China for Mastercard, said in an e-mailed reply to the Global Times.

UnionPay has also been seeking mobile payment opportunities overseas, driven by the growing number of outbound Chinese tourists.

On Friday, the company's international unit rolled out its QR payment solution at two bakeries in Singapore. It plans to introduce the new way of payment to destinations that are frequently visited by Chinese tourists, such as Thailand, Indonesia and Australia, according to a press release UnionPay sent to the Global Times.

Alipay and WeChat Pay have already extended their cashless QR payment activities into markets globally. One of Alipay's latest moves in its overseas expansion was its grand entry into more than 2,100 7-Eleven convenience stores in Malaysia on May 22.

Still, analysts believe that UnionPay has a shot at a leading position in the global mobile payment battleground, as the market, especially in South Asia and Southeast Asia, is not as concentrated or fiercely competed as it is in China.

UnionPay's mobile payment business can tap the rich resources accumulated via its previous expansion of bank card payment services, Li added.

As of mid-March, more than 20 million stores overseas supported payments settled by UnionPay cards, according to information on the website of UnionPay. The penetration rate of UnionPay cards in Southeast Asia exceeded 70 percent as of that point.

UnionPay credit cards can also be used at more than 80 percent of stores in the U.S. Analysys International analyst Wang Pengbo said that UnionPay has no choice but to launch a QR payment solution, despite the fierce competition at home.

"The company's profits are being squeezed greatly, as its core business - card clearing - has encountered headwinds caused by the booming mobile payment," Wang told the Global Times Monday.

UnionPay's net profit in 2016 rose 36 percent year-on-year to 3.3 billion yuan, a sharp slowdown from the growth rate of 92 percent in 2015, the Economic Observer reported in April, citing the company's annual report.