Competition intensifying in online payments, logistics services

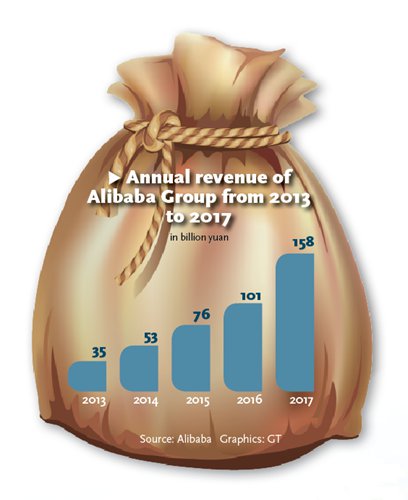

Internet giant Alibaba Group Holding said on Thursday that its revenue grew 56 percent year-on-year to 158.3 billion yuan ($22.97 billion) in fiscal 2017, which ended on March 31, thanks to its core e-commerce business. Analysts said that expanding into new territories will help the company maintain momentum in the coming years.

Monthly mobile active users reached 507 million, according to the annual financial report released on Thursday. The company has achieved the fastest growth since its IPO in 2014, it said in a statement sent to the Global Times.

Alibaba and Tencent Holdings, which both have market capitalizations exceeding $300 billion, released their financial results this week.

With 500 million users on Alibaba's platforms, the company maintained its growth momentum, which could "enable us to invest more in sectors such as cloud computing, digital media and entertainment," CEO Zhang Yong said in the statement.

In the fourth quarter of fiscal 2017, the core business of e-commerce grew 47 percent on a year-on-year basis, to 31.6 billion yuan, and the company actively built a "new retail" business model by teaming up with other brands, the statement showed.

The company's strong revenue growth reflected the growing demand of Chinese consumers, Liu Dingding, a Beijing-based industry analyst told the Global Times on Thursday. "With the expanding penetration of the Internet, the growth is expected to continue in the near future," he said.

E-commerce in China grew 39 percent last year to 5.3 trillion yuan, according to an annual report released by the China E-commerce Research Center on Wednesday. Alibaba's business-to-customer (B2C) platform Tmall accounted for about 58 percent of the total market share in the B2C sector, followed by online retailer JD.com with 25.4 percent, the report noted.

Tmall Supermarket, the company's grocery and consumer goods platform, has been generating more cash flow for Alibaba due to its different methods of account settlement with its suppliers, Lu Zhenwang, CEO of Shanghai-based Wanqing Consultancy, told the Global Times on Thursday. "It aims to have deeper cooperation with suppliers, which can help Tmall generate more profits, not just be an online platform," he said.

However, Alibaba may face more intense competition in different business segments including online payments, retail and logistics services, analysts predicted.

Tencent, a major rival for Alibaba, outstripped expectations on Wednesday with the help of its payment services. Total revenue for the first quarter of 2017 reached 49.55 billion yuan, up 55 percent on a year-on-year basis, according to its financial results.

"Tencent has surpassed Alibaba's payment service Alipay in terms of small offline payments and WeChat payments, and it is likely Tencent will continue to outperform in large online and cross-border transactions in the future," Liu said.

Besides online payments, Alibaba may feel more pressure in the retail and logistics sectors, from its rivals JD.com and domestic discount online retailer Vipshop, the analyst noted.

Still, Alibaba has seen its businesses such as cloud computing and expansion overseas grow in the past year. Total revenue generated by Aliyun reached 6.7 billion yuan in 2016, up 121 percent year-on-year, according to the report. It has become a major cloud services and solutions provider in industries such as energy, financial institutions, health and manufacturing, the report showed.

Alibaba may see its revenue growth rate decelerate in the coming years, as well as that of its profits, Lu noted. "Take a look at its rivals beyond China, like Amazon, which records slower revenue growth but sees new businesses coming in like e-books, which help boost its market value," the analyst said.

"How well those new businesses like logistics services provider Cainiao and cloud services operator Aliyun generate profits will decide how well Alibaba performs in the future," Lu said.