Graphic/GT

Part of global strategy, but observers wonder about capital sources

Chinese conglomerate HNA Group Co has made a general offer for Singapore-listed logistics provider CWT, after almost one year of talks in a deal valued at about $1.4 billion, according to a filing by HNA to the Hong Kong Exchanges and Clearing Sunday.

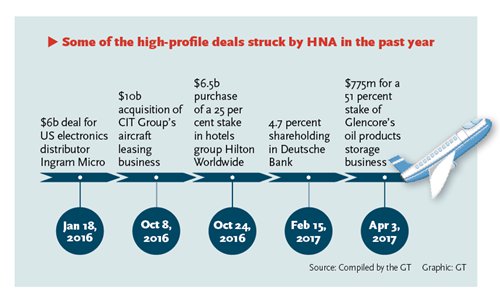

The deal would lift the total value of HNA's transactions over the past 28 months to more than $40 billion, according to a Financial Times analysis of Dealogic data Monday.

"HNA's proposed purchase of CWT is in line with its global expansion strategy because its traditional airline business can be included in logistics from a broader perspective," Liu Shengjun, an economist, told the Global Times on Monday.

Liu said that the purchase will enhance HNA's logistics service ability globally if it is approved. The deal should not be considered as a one-off investment or even a simple conversion of yuan to dollars.

As "one of China's most aggressive buyers," according to the Wall Street Journal on Sunday, HNA has been seeking growth in sectors globally such as property and tourism.

Since the start of 2017, the Chinese airline operator has been connected to more than 10 merger and acquisition (M&A) deals, including talks for a stake in Switzerland-based airport retailer Dufry AG and US business magazine Forbes in March and Germany's state-owned HSH Nordbank in April, according to media reports.

But all these deals have raised questions over its sources of capital, since Chinese regulators have been tightening controls over capital outflows since November, the Financial Times said.

HNA has moved quickly on the global M&A front in recent years thanks to China's ample foreign exchange reserves and the government's encouragement of Chinese companies to go out. Companies that have done likewise include Anbang Insurance Group and Dalian Wanda Group, Liu said, noting that HNA aims to be a truly transnational company by integrating global resources.

However, HNA is likely to slow the pace of its global drive now that the government's stance on overseas investment has become more guarded under the pressure of capital outflows, he predicted.

HNA's non-strategic purchases in sectors such as property and hotels, which are hard to classify as investment or speculation due to limited statistics, will be affected as its policy becomes more focused on the strategy and resource side, he said.

HNA said in the filing that it has been actively assessing the global market for investment opportunities to complement its existing businesses as it strives to become a leading diversified international investment company.

The acquisition of CWT is in line with the group's investment principles of prudent and justifiable investments. The deal will see the Singapore-based target benefit from China's "One Belt, One Road" initiative, according to HNA.

"HNA's pace of acquisitions has really been fast, and worries over the source of its capital are understandable. But if the company aims to internationalize its business and can make profits while doing so, now is a good time for HNA to expand globally," Chen Fengying, an expert at the China Institutes of Contemporary International Relations, told the Global Times on Monday.

Chen said that authorities should focus on tightening regulations of the sources of the domestic company's capital as well as where the money goes.

It is crucial to consider overseas purchases from the strategic point of view for Chinese companies to see if a particular deal is in line with a company's business development, Liu said.

"Chinese companies should also attach importance to post-purchase integration and enhanced management ability or it means little as a passive investor," he added.

CWT's shares closed 9.18 percent higher on Monday at S$2.26 ($1.6).