Nation's petroleum leaders reacting rationally to global markets

A decline in oil investment in China may cause crude output, already declining, to fall further, according to some industry experts. But others argue that lower investment may be just a rational reaction by local industry players to the global market.

Liu Keyu, an energy researcher at the CNPC Economics & Technology Research Institute, said at a launch event over the weekend for a report on China's energy industry that domestic crude output had for the first time shrunk by a significant margin this year, an unprecedented development in the history of China's petroleum industry.

Liu said the situation was related to the freefall of global crude prices in recent years and China's own slowing economy, as well as softer growth in domestic oil and gas consumption.

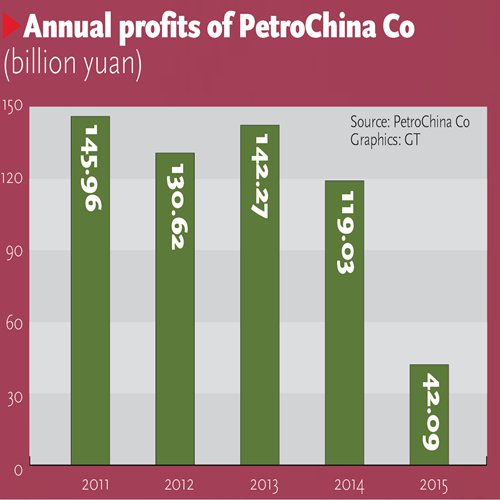

Low oil prices caused the nation's three oil giants - China National Petroleum Corp, China Petrochemical Corp and China National Offshore Oil Corp - to underperform in the upstream segment in the first three quarters of this year.

In September, the nation's large and medium-sized enterprises reported a decline of 9.8 percent year-on-year in crude output, data from the National Bureau of Statistics (NBS) showed. In the first three quarters, domestic crude output dropped 6 percent from the same period last year, the NBS said.

China's domestic gasoline price is tied to international oil prices, with the National Development and Reform Commission adjusting prices periodically.

Experts said low oil prices have caused a chain reaction, causing the three oil giants to cut spending in upstream exploitation.

Spending on oil exploitation declined from a peak of 420 billion yuan ($61 billion) in 2013 to 280 billion yuan in 2015, according to Liu.

In 2016, spending has fallen short of plans for 250 billion yuan for this purpose. In the long term, weak input in exploitation will cause output to dip further, especially as many of the nation's high-quality oil fields have been depleted, Liu said.

Li Li, director of research at Shanghai-based research and consulting firm ICIS China, told the Global Times Wednesday that the changes are actually rational.

"Cuts in crude output and production spending can be interpreted as efforts by the oil giants to streamline their operations. In the process, inefficient high-cost wells are closed and costly projects called off. It should be read as a positive change," Li said.

The freefall in global crude prices has also created ground for a new type of thinking, according to Li.

"In the past, China treated the matter of reliance on imported crude very seriously and tried to be as independent as possible," Li said.

"Nowadays, more people began to realize it can also be positive if we have secure import sources, especially when global oil prices are at long-term record lows," Li said.

In the first 10 months of this year, crude imports increased by 13.57 percent year-on-year, while exports of refined oil products surged 37.4 percent, customs data showed.

CNPC 'preparing to split' pipeline operations, gas sales

China National Petroleum Corp (CNPC) is preparing to separate its natural gas pipeline operation business and gas sales into two separate units, the Securities Daily reported Wednesday.

The report said CNPC is "formally" revamping its natural gas sales and management system through the split.

In 2015, CNPC supplied 122.6 billion cubic meters of natural gas in China, accounting for 70 percent of the national total.

Experts said the apparent step by CNPC will pave the way for further reforms to make the nation's natural gas market more market-oriented.

"While the short-term impact of the split will be low, the step is a move toward the direction of reform," Lin Boqiang, director of the Center for Energy Economics Research at Xiamen University, told the Global Times on Wednesday.

Lin said the new units will be financially independent after the split.

China is pursuing market-oriented reform in the oil and gas sector.

The country's first national-level energy trading center - the Shanghai Petroleum and National Gas Exchange - officially began operation on Saturday.

It is estimated that natural gas transactions via the platform will exceed 15 billion cubic meters this year, representing 8 percent of China's total gas consumption, according to media reports.