Smaller institutions show faster profit gains, better asset quality

Nonperforming loans (NPLs) at domestic banks have been reined in, according to data released by 22 mainland-listed lenders in their third-quarter financial reports in recent days.

Experts nevertheless cautioned on Monday the banks' NPL ratios might rise further unless these lenders take steps such as diversifying their profit models.

According to those financial reports, the quality of many domestic banks' assets has improved, although to a very slight extent, in 2016. China Construction Bank, for example, had an NPL ratio of 1.56 percent by the end of the third quarter, down from 1.58 percent by the end of 2015.

The NPL ratio of China Minsheng Bank dropped 0.03 percentage point from the end of last year to 1.57 percent by the end of the third quarter.

"A major reason for the slumping NPL ratios is the slowing growth of banking credit as the domestic economy spirals down," said Dong Dengxin, director of the Finance and Securities Institute at Wuhan University of Science and Technology.

According to data released by the People's Bank of China, the central bank, on October 18, domestic banks made yuan-denominated loans of about 104 trillion yuan ($15.36 trillion) by the end of September, up 13 percent year-on-year. The growth was slower than the 15.4 percent growth by the end of September 2015.

But Dong told the Global Times on Monday that compared with many international banks, whose NPL ratios are below or just slightly above 1 percent, domestic banks still have relatively high risks involving bad loans. He also noted that the third-quarter improvement might be temporary.

According to Dong, whether or not domestic banks' NPL situation will deteriorate further depends on two things.

First, banks need to shift their profitability model from being overly reliant upon loan-deposit spreads to diversified income channels, such as by developing off-balance sheet activities.

Second, banks can also take measures such as increasing their efforts to resolve or write off bad loans to reduce their NPL ratios.

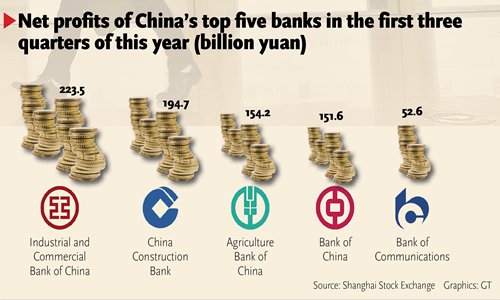

The financial reports also showed that major State-owned commercial banks still have a strong capacity to earn profits. Industrial and Commercial Bank of China (ICBC) led in terms of profitability. ICBC made a profit of 223.5 billion yuan in the first three quarters of this year, up 0.53 percent year-on-year.

China Construction Bank generated a profit of 194.7 billion yuan in the first nine months of this year, up 1.35 percent year-on-year.

The smaller municipal commercial banks, however, were the ones that came out top in terms of profit growth, although the scale of their profits was relatively small compared with the larger commercial banks. Bank of Nanjing, for example, saw its net profit rose 22.67 percent year-on-year to 6.35 billion yuan by the end of the third quarter, the biggest gain among those banks.

She Minhua, an analyst from Zhong De Securities, said that municipal commercial banks have a smaller profit base than the State-owned commercial banks, so it's easier for them to achieve profit growth.

She also told the Global Times on Monday that the quality of municipal commercial banks' assets is usually better than that of bigger banks, helping them achieve higher profit growth.

However, She stressed that in general domestic banks are still under great operating pressure.