Evergrande divestment shows need to focus on core assets: experts

Domestic real estate companies are ramping up investment portfolio diversification in the midst of China's booming property market, but experts noted on Wednesday that developers should be cautious in expanding into sectors that are not related to their core assets.

China Evergrande Group, the country's leading property developer, has provided a lesson. The property company said on Wednesday that it was selling three groups of non-core assets, including its dairy, spring water as well as grain and edible oil units, in deals worth a total of 2.7 billion yuan ($405 million).

The builder will sell its grain and edible oil operations for 600 million yuan, its dairy business for 300 million yuan, and its spring water unit for 1.8 billion yuan, according to a filing the company sent to the Hong Kong Stock Exchange on Wednesday.

Buyers will pay 10 percent down to Evergrande within three days of the agreements, with the remainder to be paid over the next three years.

By selling off the three businesses, which have total debt of 3.3 billion yuan, Evergrande is estimated to record a pre-tax gain of 5.7 billion yuan, according to the filling.

The sales are "a strategic consideration" that will enable the company to focus on the development of property and other related business, Evergrande said in the filing.

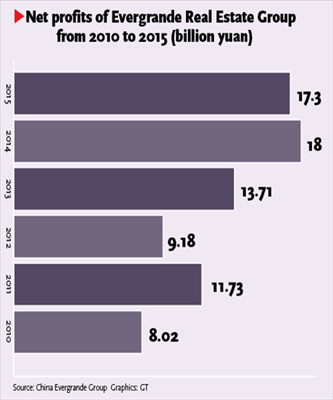

"The withdrawal proves that the company has failed in its attempt" to enter the fast-moving consumer goods (FMCG) market," said Zhang Jiayuan, an analyst with China Investment Consulting Co, noting that those businesses have been a drag on the company's overall financial performance for three consecutive years.

Even the spring water sector, which has yielded household brands like Evergrande Spring, incurred 2 billion yuan and 2.36 billion yuan losses in 2015 and 2014, respectively, according to the company's financial statements.

In contrast, Evergrande's property-related business units, including finance and sports, still have great growth potential, experts noted.

For example, revenue from the sports sector surged 11 percent year-on-year to 380 million yuan in 2015, with club ticket sales at a new high of 210 million yuan, according to the company's financial statement.

"This is because those sectors' operating models, in which property developers have built up experience, are different from those of the FMCG industry," Zhang Hua-xue, deputy general of the China Index Research Institute, told the Global Times on Wednesday.

"Property-related sectors generally require large investments but offer quick, high returns. Building up a FMCG base involves a long period of customer cultivation and marketing, which inevitably means losses that real estate companies can't accept," he said.

Evergrande was a pioneer in diversification in the property sector, and other domestic developers have considered similar moves in recent years, according to media reports.

Dalian Wanda Group boosted its leisure and entertainment operations by opening theme parks, for example, while Greenland Group set up a service to offer Internet finance in November 2015.

"These moves have taken advantage [of the resources provided]by the recent booming property market and soaring housing prices," Zhang of China Investment Consulting told the Global Times on Wednesday.

In the first half of 2016, there were five developers whose sales revenues exceeded 100 billion yuan, according to a report Centaline Property sent to the Global Times on Tuesday.

"Business diversification will raise real estate giants' competitiveness, but they also need to be aware of their core advantages and avoid the mistakes made by Evergrande," Zhang said.

Evergrande's shares in Hong Kong were up 0.37 percent to HK$5.39 ($0.69) at Wednesday's close.