Graphics: GT

The first six months of 2016 were the "most special half year" for China Vanke Co since its establishment in 1984, as the Shenzhen-based real estate company's operations were affected by an ongoing ownership battle, a Vanke executive said during the company's interim results conference held on Monday.

Board Secretary Zhu Xu said intervention by domestic regulators should help resolve the ownership dispute.

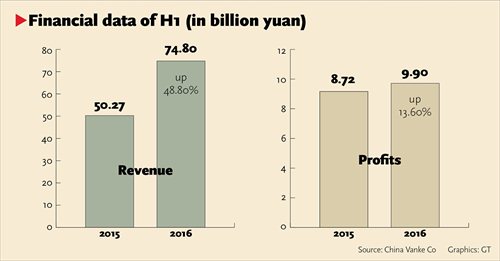

First-half revenue rose more than 48.80 percent to 74.80 billion yuan ($11.3 billion), while profits were up 13.60 percent to about 9.90 billion yuan, according to the interim report released on Sunday.

Dong Dengxin, director of the Finance and Securities Institute at Wuhan University of Science and Technology, told the Global Times on Monday that the real estate industry has a long business cycle, meaning that the impact of the ownership battle won't immediately be reflected in Vanke's financial data.

The ownership battle has already had a negative impact on Vanke's operations, stcn.com reported on Monday, citing Zhu.

More than 30 business partners sought to postpone joint projects with Vanke or considered ending their cooperation with the company between the end of June and the beginning of August, Vanke disclosed in its interim report.

"Vanke's business success is in many ways closely linked to the company's brand and the confidence the market has in its current management model," Dong noted. "But with the ownership battle, the company's business partners wonder if the ownership change will alter or even destroy Vanke's business model."

Zhu also said Vanke's team stability was hurt in recent months by the battle, according to the report by stcn.com.

Such a situation "will definitely lead employees to resign as they are unsure of the future," said Yin Zhongli, a research fellow at the Chinese Academy of Social Sciences, adding that teams from Vanke are popular on the job market.

The struggle over Vanke can be dated back to mid-2015, when Shenzhen Jushenghua and Foresea Life Insurance, two units of Baoneng Group, started to build up stakes in Vanke. They hold nearly 30 percent of the company's shares in total now.

The battle escalated in June, when Vanke's management team announced an asset restructuring plan with Shenzhen Metro Group, which would have overtaken Baoneng as the largest shareholder of the developer.

Zhu said that Vanke's shareholders have not yet reached a consensus about the plan to buy Shenzhen Metro's assets.

Also, Vanke has asked smaller rival China Evergrande Group why it has been building up a stake in the company, but it has not received an answer, an Vanke executive said on Monday, Reuters noted.

Zhu noted that as long as shareholders are buying or selling shares for the good of the company, it's "fine."

Vanke's shares rose 0.45 percent to 24.7 yuan per share on Monday.

"Vanke's ownership battle is becoming increasingly mysterious. It's hard to predict the ultimate outcome, as the goal of the new shareholders, whether to strengthen or destroy Vanke, is unclear," Dong said.

Dong said it's possible that the Vanke brand might even vanish. "The real estate market is never short of new juggernauts."

Zhu also noted that government regulators might be helpful in solving the dispute, but Vanke is still waiting for their replies on this issue, according to the report.

Yin told the Global Times on Monday that regulators should not be biased toward any side in such a case. Yin also noted that the ending of the battle is hard to predict.

Vanke Chairman Wang Shi didn't attend the conference on Monday.

Zhu disclosed that Vanke has no intention to buy other listed companies, according to the report. Zhu also said that leading global financial analysis agencies like S&P might adjust their credit ratings for Vanke, and Vanke's business might face even bigger challenges in the remaining months of 2016.