Graphics: GT

Analysts see wave of policy tightening on the way in 'hot' second-tier cities

Suzhou in East China's Jiangsu Province announced Thursday on its government website a raft of new policies for the housing sector, with regulations that analysts said put a loose restriction on home purchases.

Experts said governments in certain second-tier cities are reacting to rapid gains in home prices and a tide of policy tightening is set to sweep through several hot markets.

Suzhou imposed purchase restrictions in March 2011 during a nationwide effort to curb speculative demand. It lifted those rules in September 2014 to boost demand as housing sales cooled.

Among more than 40 Chinese cities that implemented restrictions on home purchases in 2011, only a handful - including the first-tier cities of Beijing and Shenzhen, South China's Guangdong Province - have maintained those rules without interruption.

Nanjing, capital of East China's Jiangsu Province, raised the down payment requirement for second home buyers to 50 percent from 45 percent on Thursday, media reports said. On Tuesday, Hefei, capital of East China's Anhui Province, announced a ban on mortgages for anyone who already owns two homes, unless all the mortgages have been paid off, the Beijing Youth Daily reported Thursday.

Wuhan in Central China's Hubei Province and Xiamen in East China's Fujian Province rolled out similar measures in March and July respectively.

In announcing its new property policies, the Suzhou government altered the city's land supply and bidding process, as well as mortgage conditions such as down payment requirements and eligibility to borrow.

One notable change in the new policy is that - similar to the rules in Hefei - local buyers who already own two or more housing units can't get a new mortgage, unless they've entirely paid off the loans on previous properties.

For buyers living in Suzhou who don't have a local hukou (household registration), the new rules require payment of social insurance or tax receipts for one year or more for the purchase of a second home.

"The one-year requirement on taxes or social security is not as difficult to meet as the two- or three-year requirements seen in the last round of home purchase restrictions, so the new restriction is loose," Hu Feichuan, an analyst with financial information provider rong360.com, told the Global Times on Thursday.

Yan Yuejin, a research director at the Shanghai-based E-house China R&D Institute, told the Global Times on Thursday that Suzhou's policy is in line with the spirit of the supply-side structural reform heralded by the central government.

"Increased land supply stated in the rule could give a sense of certainty to property developers and should help stabilize housing prices," Yan said.

According to a report by the China Business News on Thursday, Suzhou has been losing its luster for those seeking urban hukou due to rising costs, declining exports and the rise of new manufacturing hubs in inland China such as Chongqing in the past five years.

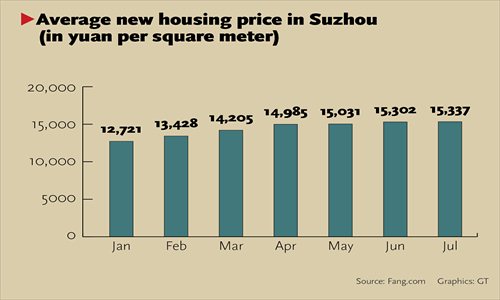

However, data released by the housing information provider fang.com indicated that the average price of new housing in Suzhou was 13,835 yuan ($2,084) per square meter in the first four months of the year, increasing more than 20 percent year-on-year.

Property developers are also keen to grab sites in Suzhou, according to media reports.

"The policy shifts reflect changing market demand and supply. Property markets in Suzhou, Nanjing, Hefei and Xiamen are doing quite well, so there's a need to cool them down," Hu said.

"But other second-tier cities, still facing a supply glut, do not need restrictions on home purchases yet," Hu noted.

Yan said the restrictions imposed by the -Suzhou authorities are still modest and pose no great limitations for people who work in the city.

Yan noted that about 10 cities will follow -Suzhou's lead with tightening moves in the third quarter.

Fitch Ratings Inc said on Sunday that China's housing demand will remain relatively resilient through 2030.