(Graphics/GT)

Anti-monopoly investigation unlikely, according to experts

Chinese ride-hailing service giant Didi Chuxing announced on Monday that it has reached a strategic agreement to acquire Uber China, a move experts said will strengthen Didi's dominant market position.

Some have raised the question if the merger between Uber China and Didi, the two largest Internet ride-hailing platforms in China, would be subject to anti-monopoly reviews.

But earlier data suggests that the merger between Uber China and Didi didn't reach the scale that would require anti-monopoly approval.

Chen Wei, a senior consultant with Beijing-based investment consulting firm ChinaVenture, said he thinks an anti-monopoly investigation seems unlikely.

The deal is poised to result in a de facto monopoly for China's ride-hailing industry, therefore to protect the interests of users, it is essential for the Ministry of Commerce to seek opinions from consumers, drivers, other industry players before giving a go-ahead, so as to prevent Didi from abusing its market dominance, Li Yi, an expert at the Internet Society of China told the Global Times on Monday.

According to rules published by the State Council, China's cabinet, in 2008, potential mergers are required for anti-monopoly reviews according to a two-part test: if total annual revenue generated in China of all the involved companies exceeded 2 billion yuan ($301.34 million) and if at least two of the companies' revenues each exceeded 400 million yuan.

In 2015, the revenue of Didi was over 6 billion yuan, news portal toutiao.com reported in March. Uber China's revenue in 2015 was unlikely to exceed 400 million yuan, according to a report by finance.qq.com on Monday. Therefore, the second condition wasn't met, and the merger between Uber China and Didi is not required to be submitted for anti-monopoly reviews.

The transaction will be conducted through a share swap, with Didi and Uber China becoming minority shareholders in each other. Uber China will hold a 5.89 percent stake in Didi, according to a statement Didi sent to the Global Times on Monday. Didi didn't disclose its holding in Uber China.

Alibaba Group Holding and Tencent Holdings have invested in Didi while Baidu Inc is an investor in Uber China. After the deal, Didi will thus become the only company in China to have received investment from China's three Internet giants.

A Bloomberg report, citing people familiar with the matter, said on Monday the deal values the combined business at $35 billion.

For years, both companies have spent big to lure customers in China. Uber China spent $1.5 billion in 2015, while Didi's annual subsidies reached as much as $4 billion, news portal jiemian.com reported on July 25.

Bloomberg also mentioned that Uber's investors had been pressuring the company to stem the losses in China. A major aspect of the merger is cost cutting, said Chen.

The deal came within days of China's legalization of online car-booking services, and experts said the new regulation likely sped up the agreement.

On Thursday, seven government ministries led by the Ministry of Transport jointly issued a regulation on managing the online car-booking industry, which will take effect in November. The regulation makes China the first major country to legalize ride-sharing services.

Didi said in an open letter last week that it welcomed the new regulation, but Li said that the deal puts Didi at a disadvantage.

The regulation establishes a general framework for the sector and allows local governments to decide things like fares and requirements for operating licenses, but Didi has already reached agreements with a number of key cities, which means its costs could be much higher than those of other operators, Li explained.

But according to Chen, with the legal status of ride-sharing services having been resolved, Didi's rivals in China will face great pressure from its dominant market share.

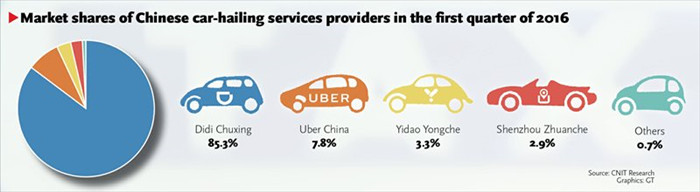

In the first quarter of 2016, Didi had 85.3 percent of the market in China's private car-hailing -segment, while Uber China only had 7.8 percent, according to a report issued by Beijing-based data research institution CNIT Research.