Innovation only way to beat cheaper domestic brands: analysts

Apple Inc has been losing ground to Chinese smartphone makers in recent years due to a lack of creativity and stiffer competition, analysts said on Wednesday after the U.S. technology giant announced its financial results.

Apple posted declines in revenue and profit in its fiscal 2016 third quarter, or three months ended June 25, 2016, it said on Tuesday (U.S. time).

It recorded revenue of $42.4 billion, down 15 percent year-on-year, while net income fell about 27 percent to $7.8 billion, the results showed.

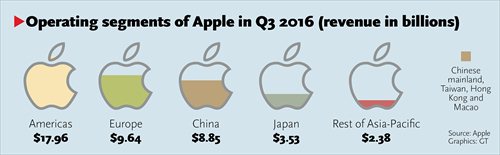

Business in Chinese mainland, Taiwan, Hong Kong and Macao fared worst, with revenue down 33 percent to $8.85 billion. The Americas, with $17.96 billion of revenue, remained Apple's biggest operating segment.

China is no longer the company's second-largest market, having been replaced by Europe with $9.64 billion in quarterly revenue, the results showed.

Apple's China division did not respond to an interview request from the Global Times as of press time on Wednesday.

Apple has been facing intensifying competition from domestic brands in China in recent years, with many such companies offering a similar user experience at a cheaper price, Liu Dingding, an independent industry analyst, told the Global Times on Wednesday.

Besides, many iPhone users are waiting for the release of the iPhone 7, which has been reportedly set for September. That's another reason why people stopped buying the iPhone 6 and iPhone 6S, Liu noted.

Sales from iPhones accounted for about 57 percent of total product revenue, according to the results.

The new product is likely to unleash pent-up demand in the Chinese market, as the iPhone 6 and iPhone 6s share so many similarities that users have been discouraged from updating their gadgets, Zhu Dalin, an analyst at consultancy Analysys International, told the Global Times on Wednesday.

"In general, it takes two years to update a smartphone, which explains why there was growth [for Apple] in 2015," Zhu said.

However, the U.S. tech giant has not only had to cope with the rise of Chinese brands such as OPPO and vivo. It's also had to continue competing with the world's third-largest smartphone vendor, Huawei Technologies Co, which made its operations in the Chinese market even more challenging, analysts noted.

In the first quarter of 2016, OPPO and vivo shipments picked up mostly due to investments in marketing and an increase in their distribution channels, according to a report published by International Data Corp (IDC) on its website on May 16.

Shipments by OPPO during this period reached 15.8 million, which gave it 15.4 percent of the market in China, the report said. Huawei, OPPO and vivo were ranked as the top three smartphone vendors in the first three months.

"OPPO and vivo are gaining bigger shares through attracting more young consumers and expanding in second-tier cities," Zhu said.

A Beijing-based 30-year-old white collar surnamed Long said he just switched from an iPhone to Huawei P9, because he was attracted by the dual-lens camera jointly developed by Huawei and Leica.

"Though I was committed [to Apple] from the iPhone 4 to the iPhone 6, I want to try something new," he told the Global Times on Wednesday. "And Huawei has put more effort into innovation than Apple."

Huawei's sales revenue grew 41 percent on a year-on-year basis to 77.4 billion yuan ($11.6 billion) in the first six months of this year, the Shenzhen-based company said on Tuesday.

Some of its flagship products also saw robust growth. For example, 4.5 million P9 and P9 Plus devices were sold during this period, of which the number sold internationally increased 120 percent when compared with sales of the prior model, the P8, during the same period in 2015.

However, Apple's weak quarterly results don't necessarily mean that it's lost all of its competitiveness in the Chinese market, as it still has a strong user base in the high-end segment, Zhu noted.

"But the company has to step up efforts in coming up with more creative ideas not only in products but also in services," he said.