Stronger dollar, economic recovery make U.S. top target: report

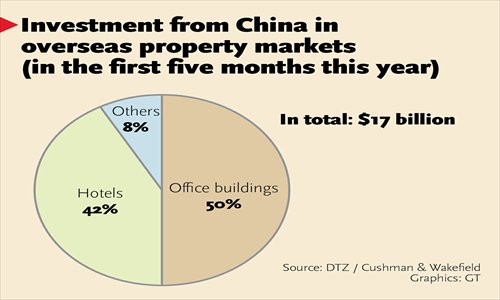

Chinese investments in overseas real estate markets reached $17 billion in the first five months of 2016, already surpassing more than 65 percent of last year's total and making China the second-largest source of global property investments, according to a report released by DTZ/Cushman & Wakefield on Tuesday.

But that increase came as Chinese investors face tougher obstacles in purchasing real estate assets overseas, following moves by some foreign governments to impose higher taxes on foreign purchases.

Overseas real estate investments from China in the period reached 65.6 percent of the total investment of about $25.73 billion made in 2015, with the U.S. being the most popular market for Chinese investors, attracting 62.3 percent, or $10.6 billion, of the total, according to the report, which was sent to the Global Times on Tuesday.

The wave of Chinese investments in the U.S. in the first five months of the year, which already surpassed last year's total of $4.37 billion by 143 percent, has been propelled by a strengthening dollar and recovery in the U.S. economy, James Shepherd, executive director of the greater China research team at DTZ/Cushman & Wakefield, said in a separate press release on Tuesday.

However, Chinese investors' strong appetite for real estate assets in foreign countries is facing increased obstacles.

While the U.S. has not imposed any new restrictions on foreign real estate investors, other popular destinations for Chinese investments like Canada and Australia have introduced tighter restrictions and higher tax rates for property purchases involving foreign buyers.

The British Columbia (BC) provincial government in Canada on Monday announced an additional property transfer tax rate of 15 percent on residential real estate purchases in Metro Vancouver made by foreign nationals or foreign-controlled corporations, according to a press release on the government's website.

The new measure, which is set to take effect on August 2, was aimed at cooling the red hot real estate market in southern BC, which is driven by foreign investments.

"The intention of such policies is very clear, that it is aimed at cracking down on property speculation," Yan Yuejin, a research director at the Shanghai-based E-house China R&D Institute, told the Global Times on Tuesday.

"While investment from outside Canada is only one factor driving price increases, it represents an additional source of pressure on a market struggling to build enough new homes to keep up," said BC Finance Minister Michael de Jong in the press release.

Foreign buyers purchased over $1 billion worth of property in BC between June 10 and July 14, according to the BC government.

The Vancouver Sun reported on Monday that the majority of the foreign investors were from China.

Canada's move on Monday followed similar measures taken by some parts of Australia recently.

The states of New South Wales, Queensland and Victoria have announced different rates of stamp duty, ranging from 3 percent to 7 percent, and land tax surcharges, ranging from 0.05 percent to 1.5 percent, for foreign property investors, mainly from China, according to a report from the Australian Financial Review on July 6.

While these moves don't target any particular group of foreign investors, they do reduce the return on real estate investments in these countries, making the real estate markets there less attractive, Yan said.

"These policies are bad news for overseas real estate -investments," Yan noted. "They will raise the cost of foreign transactions and reduce the advantage of buying homes overseas, and they'll likely lead to a slide in the spree of overseas real estate investments."