(Graphics/GT)

Contingent liabilities a major source of risk, experts warn

The reform of China's State-owned enterprises (SOEs) is likely to move at a slow pace as these companies are seeing their profits decline and liabilities increase, experts said on Sunday.

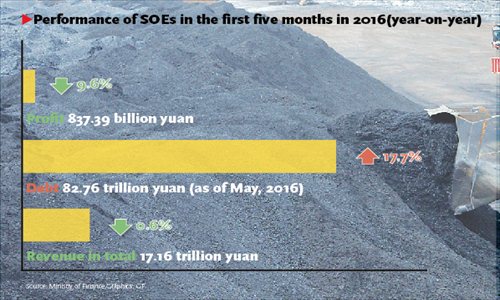

During the first five months of the current year, profits at China's SOEs decreased 9.6 percent year-on-year to 837.39 billion yuan ($126.61 billion), worsening from the 8.4 percent fall registered in the first four months, according to data released by the Ministry of Finance (MOF) on Friday.

Wang Danqing, a partner with Beijing-based ACG Management Consultancy, attributed the drop in part to the sluggish global economy, which "also slowed down the profit growth at privately owned companies and foreign-invested ones in China."

In April, China's major industrial companies saw their overall profit growth slow sharply, with a gain of 4.2 percent year-on-year, compared with an 11.1 percent rise in March, data from the National Bureau of Statistics (NBS) showed.

Still, "domestic SOEs are facing a tougher time than privately owned companies or foreign-invested ones, because about 70 percent of them are engaged in heavy industries like coal and steel that are battling significant overcapacity and declining prices," Wang told the Global Times on Sunday.

Data from the MOF indicated that the coal, steel and nonferrous metals sectors recorded losses during the January-May period, while SOEs in the transportation, construction and pharmaceutical sectors saw profits rise.

The total debts of SOEs increased 17.7 percent from a year earlier, hitting 82.76 trillion yuan at the end of May, said the MOF.

The rising debts are worrying experts. Sizeable contingent liabilities, largely from SOEs, are regarded as the main source of risk facing the Chinese government, according to a report Moody's Investors Service sent to the Global Times on Thursday.

Wang said that SOE reform won't make fast progress without a solution to the problems of falling profits and rising debts.

Feng Liguo, vice-research fellow at the Beijing-based China Enterprise Confederation, agreed.

Unstable capital flows at SOEs makes them reluctant to upgrade their production lines and adjust their management practices. The problem also causes lots of debt defaults, Feng told the Global Times on Sunday.

Sichuan Coal Industry Group is one of the latest to alert its investors about a possible default, according to an announcement issued by the State-owned company on June 14.

Despite the debts, SOEs' investment in fixed assets increased by 23.3 percent in the first five months, accounting for 34.5 percent of the nation's overall fixed-assets investments, a record high proportion since 2012, data from the NBS showed.

This surprised Feng, who thought that as profits fall and debts rise, investment in fixed assets should decline.

"It seems that regional governments and banks still rely on SOE leverage to boost local economies, just like they used to do," said Feng. "If this vicious circle continues, SOE reform will go backward."

Both Feng and Wang said privately owned companies have the potential to play an increasing role in driving the country's economy. In the first five months, private investment grew 3.9 percent year-on-year, slowing down from 5.2 percent in the first four months, according to NBS.

The central government issued a series of measures to encourage privately owned companies, which experts said are prone to be more efficient in management than SOEs, to enter the energy and infrastructure construction sectors.

An inspection team was sent by the State Council, China's cabinet, to 18 provincial-level regions in May to review the implementation of those measures.

Wang Kebing, deputy director general of the Budget Department at the MOF, told a press briefing on Thursday that the government has room to raise debt levels, which will help lower corporate leverage to some extent, and the deleveraging should take place gradually.