Unit has high costs, isn't meeting U.S. retail giant's goals: analysts

E-commerce giant JD.com Inc is talking with Wal-Mart Stores Inc about the possibility of acquiring the U.S.-based company's online grocery platform in China, media reports said Monday, a move analysts said may help JD compete more successfully against Alibaba Group Holding.

Negotiations to buy Shanghai-based yhd.com, owned by Wal-Mart, have entered the final stage and the outcome will be announced soon, the Beijing Times newspaper reported. Some other media reports said that the deal could be worth some 40 billion yuan ($6.08 billion).

Both companies declined to comment on the reports when contacted by the Global Times Monday.

Eyeing the booming online retailing sector in China, Wal-Mart bought a 17.7 percent stake in yhd.com in May 2011. In October 2012, Wal-Mart increased its stake in the online grocery platform to 51 percent, and in July 2015, Wal-Mart announced that it had acquired all remaining shares of the company.

"Many people believe that online retailing represents the future and offers low costs and price advantages, but later they find that things aren't so simple," Zhang Yi, CEO of Internet research firm iiMedia Research, told the Global Times on Monday.

Zhang noted that the costs involved in online retailing, especially in the business-to-consumer (B2C) sector, are actually quite high, due to the heavy input required for labor, logistics and promotions.

"This was not expected by Wal-Mart, which had pinned high hopes on yhd.com to help the bricks-and-mortar giant expand online [in China]," Zhang said.

Liu Dingding, a senior analyst at Beijing-based Internet consultancy Sootoo, agreed.

"If the reports of an upcoming deal are true, yhd.com may have failed Wal-Mart's aspirations for the online business. If not, the retail giant wouldn't want to sell it," he said.

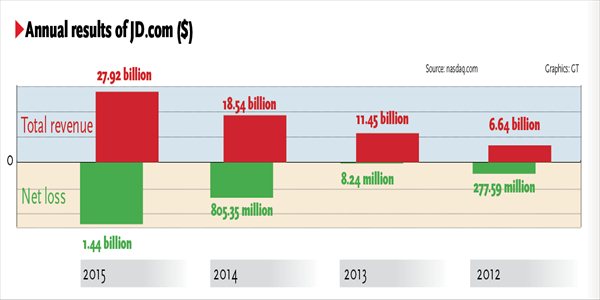

Financial details such as revenue and profit for yhd.com are difficult to obtain as it is not publicly listed, but analysts said that it is still hard for a B2C platform like yhd.com to break even. Even JD posted a net loss of 9.4 billion yuan in 2015.

In the first quarter, yhd.com had a 0.93 percent share in China's B2C e-commerce sector, ranking sixth among all B2C platforms, data from Sootoo showed in April.

Alibaba's Tmall ranked No.1 with a 58.6 percent share, followed by JD with a 21.9 percent share, according to Sootoo.

Some analysts said that the deal could help JD expand its business in East China, where yhd.com has a strong presence. And Zhang from iiMedia said after the acquisition of yhd.com, which would eliminate one potential competitor, JD could better focus on its rivalry with Tmall.

JD has never concealed its interest in the grocery business. In August 2015, it bought a 10 percent stake in supermarket chain Yonghui for 4.31 billion yuan.

However, it costs a lot of money to support the massive promotional campaigns of e-commerce platforms and pay for their expansion plans. In April, JD announced pricing of a $1 billion note offering and said that net proceeds would be used for general corporate purposes.