Stabilization policies promote recovery for companies

Inflation at the consumer level stayed modest in April, which was within expectations and unlikely to prompt aggressive monetary easing by Chinese policymakers, experts said on Tuesday.

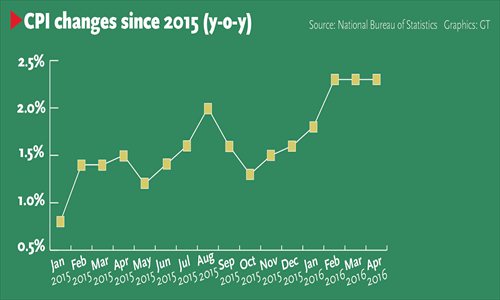

The Consumer Price Index (CPI) rose 2.3 percent year-on-year in April, the third consecutive month it increased more than 2 percent, boosted by high vegetable and pork prices, according to data the National Bureau of Statistics (NBS) released on Tuesday.

Pork prices accelerated 33.5 percent year-on-year in April, while prices of vegetables rose 22.6 percent.

The CPI in April was down 0.2 percent month-on-month.

"The data is within expectations, indicating stability in the consumer market," Zhao Xijun, deputy director of the Finance and Securities Research Institute at Renmin University of China, told the Global Times on Tuesday.

As for the drop in the month-on-month reading, Zhao said that this mainly reflected seasonal factors influencing vegetable prices.

"There still could be upward moves in the CPI due to sustained price increases in pork, services and consumer goods," Liu Xuezhi, a macroeconomist at Bank of Communications, said in a note sent to the Global Times on Tuesday.

Yao Shaohua, senior economist at Hang Seng Bank, held a different view.

"Higher pork prices alone can't drive the overall inflation level, especially considering there has been some price fallback of fresh vegetables and fruit in nearly 50 Chinese cities," he wrote in a note sent to the Global Times on Tuesday.

He estimated that the CPI will fall to around 2 percent in May.

Liu and Yao agreed that there's no obvious inflationary pressure in China.

The NBS also released data on the Producer Price Index (PPI), which fell by 3.4 percent in April, compared with a decline of 4.3 percent in the previous month.

As an important measure of prices at the factory gate, the PPI has fallen for 50 consecutive months.

Liu attributed the narrowed drop in the PPI to a recovery of demand and the price stabilization of upstream production materials, and said that the PPI drop will continue to shrink.

Zhao said that the readings for the CPI and PPI in April represent "an important sign of the stabilization of China's economy."

"The many growth stabilization policies launched by the Chinese central and local governments recently, such as tax and fee reductions, have had some effect in promoting a recovery in the production and operations of companies," Zhao said.

Market observers have speculated that the People's Bank of China (PBOC), the central bank, will relax its monetary policy to stimulate the economy.

In the first quarter of 2016, the economy grew 6.7 percent year-on-year.

Zhao noted that China's economy on the whole appears to be stabilizing, with GDP growth in line with expectations.

"So the priority goal for the central government is to maintain a stable monetary policy that can be sustained," Zhao said, adding that there will be no aggressive monetary policy moves this year.

Liu from Bank of Communications agreed, saying that there will be a prudent and neutral monetary policy.

Yao said that the PBOC will continue to lower banks' reserve ratios and cut interest rates in response to the economic slowdown.

The PBOC has expressed concerns about higher inflation, according to its quarterly report on monetary policy implementation that was released on Friday.