(Graphics/GT)

Long process lies ahead, but profits will improve: experts

Many large domestic coal producers are actively following the nation's plan to cut overcapacity in the sector, the Beijing-based Securities Daily newspaper reported on Monday.

The country will close 500 million tons of capacity and consolidate another 500 million tons into the hands of fewer but more efficient mine operators in the next three to five years, the State Council, China's cabinet, said in a guideline in February.

Overcapacity in the industry is serious, with shrinking domestic demand amid the economic slowdown making many mines redundant.

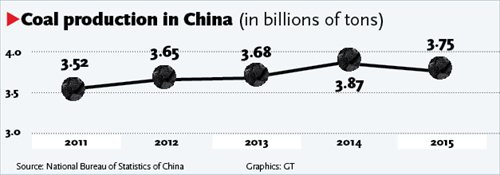

China's annual coal production capacity may have been as high as 5.7 billion tons in 2015, while demand was about 3.5 billion tons, according to media reports in January. Many coal producers have been reporting losses. Experts said China's energy structure is also changing, aided by low global crude oil prices.

The Bohai-rim thermal coal price index was about 400 yuan ($61.72) per ton as of this month, down from about 520 yuan approximately one year earlier, according to media reports.

Large State-owned companies including Shenhua Group and Datong Coal Mine Group have announced capacity-cutting plans, according to the Securities Daily.

Shenhua has focused on eliminating high-cost, low-quality mines or those that don't meet environmental standards. The company has stopped output or construction at 12 of its mines, reducing annual production capacity by 30 million tons so far this year, the Securities Daily reported.

Zhang Youxi, chairman of Datong Coal Mine Group, said earlier this month that his company plans to close 12 mines, cut capacity by 12.55 million tons and reduce losses by 1.24 billion yuan during the 13th Five-Year Plan (2016-20) period, according to the Securities Daily. In 2016, the company plans to close five mines, making about 10,000 workers redundant.

So far, eight provincial-level regions, including major coal producers such as North China's Inner Mongolia Autonomous Region and Shanxi Province, have announced action plans to cut overcapacity in the sector, according to the Securities Daily.

Other areas include Southwest China's Chongqing Municipality, Sichuan and Guizhou provinces and East China's Shandong and Anhui provinces.

Liu Dongna, a coal industry analyst with Shandong-based industry portal sci99.com, said that although a few companies have been calling for an industry-wide cut in capacity since 2014, the results have been limited.

"But in this round, with reducing coal and steel overcapacity atop the central government's agenda, we are seeing more serious cuts and we can expect a higher level of implementation," Liu told the Global Times Monday.

Li Chaolin, an independent coal industry analyst in Beijing, said that many of the localities are choosing to close unprofitable mines because of low prices.

"For instance, producers in Guizhou were able to make profits when the price was good, but they've lost competitiveness now that the coal price is low. Ensuring local employment has also been a reason for them to keep running, as less advanced mines still employ many hands to extract coal," Li told the Global Times on Monday.

However, experts said that eliminating capacity will be a lengthy process, although it will help stabilize and support coal prices.

Low coal prices, which translate into lower costs for products and services in many downstream industries such as electricity, have incidentally helped other sectors struggling with slowing economic growth, Liu noted.

Compared with privately owned mines, many of which were driven out of business long ago by losses, large coal mines face bigger problems in dealing with laid-off miners, experts said.

A recent report by investment bank China International Capital Corp forecast that this year and next, 30 percent of the 10 million people employed in China's coal, steel, electrolytic aluminum, cement and glass industries will lose their jobs. The forecast was cited in February in a report by the European Union Chamber of Commerce in China that discussed overcapacity in China.

A 40-year-old coal miner at a subsidiary of Datong Coal Mine Group based in Datong, Shanxi Province told the Global Times on Monday that he hasn't been paid for more than 10 months.

"We've been told that the company can't pay right now as it has been struggling with difficulties," he said, preferring not to be identified due to the sensitivity of the issue. He noted that like many of his co-workers, he can only wait to see if the local government will offer "supportive" policies for unpaid coal miners.