Capital outflow, not yuan support, caused decrease: analyst

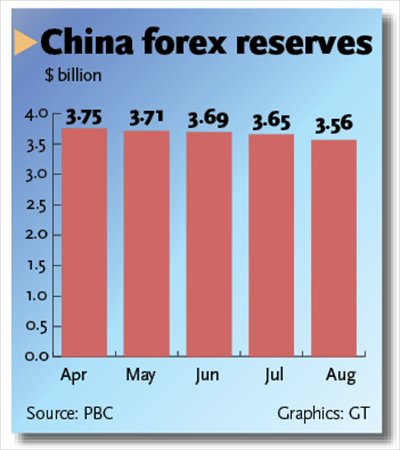

China's foreign exchange reserves fell for the fourth straight month to $3.56 trillion in August, down by a record $93.9 billion from the previous month, the People's Bank of China (PBC), the country's central bank, announced on Monday.

Analysts attributed the drop in foreign exchange reserves to recent capital outflows in addition to the country's slowing trade, denying foreign media reports, which claimed that the country's central bank is selling dollars to support the weakening yuan.

The current foreign exchange reserves mirrored a sluggish foreign trade, said Tan Yaling, dean of the Beijing-based China Forex Investment Research Institute.

"The yuan began to fluctuate in August, and is not the reason for the depletion in reserves since May," she said.

On August 11, the central bank devalued the yuan by about 2 percent against the US dollar, the biggest one-day currency devaluation in nearly two decades.

Amid worries that the yuan would slide further in the near future, the PBC said that there is no need for continued yuan devaluations both domestically and globally, citing the country's sound macroeconomic environment, massive trade surplus and ample foreign exchange reserves, reports in August said.

However, the two-day devaluation could also be seen as a way to help the country's exports as well as overall economic growth, Tan told the Global Times Monday.

"The country's accumulation of foreign exchange reserves was driven by a huge trade surplus over decades," Tan said, adding that slower export growth for some months in the past also affected the amount of foreign exchange reserves.

Balancing act

China's exports fell by 0.9 percent in the first seven months of 2015 compared to the same period last year, and slumped by 8.9 percent in July alone, reports last month said. And the sector is facing tougher and more complicated situations at home and abroad, as well as uncertainties, Shen Danyang, spokesman of the Ministry of Commerce (MOFCOM), was quoted as saying in the reports.

Ding Zhijie, an economics professor at the University of International Business and Economics in Beijing, echoed Tan's view.

"While foreign exchange reserves have to be maintained at a reasonable level, authorities are also seeking to reduce foreign reserve risks while controlling the inflow of hot money," Ding said, adding that lower foreign exchange reserves are not necessarily a bad sign.

He said cutting the banks' reserve requirements (RRR) and lowering key interest rates in August was likely to drive away certain amounts of foreign speculative capital.

In August, the PBC announced a cut in the RRR by 50 basis points. And the benchmark interest rate has also been reduced. Interest rates for one-year loans and deposits have been cut by 25 basis points to 4.6 percent and 1.75 percent, respectively.

Meanwhile, onshore foreign exchange trading saw the yuan's value slide by about 0.2 percent, and closed at 6.37 against the US dollar Monday, which was the biggest drop since August 24, news portal ifeng.com reported.

Still, investors and traders should not be too worried about the drop in foreign reserves, said Zhang Yu, an economist at Minsheng Securities, in a research note sent to the Global Times Monday.

"The country still retains huge currency reserves to prevent the yuan from further weakening," she said.

PBC governor Zhou Xiaochuan told a meeting of G20 finance governors in Turkey over the weekend that the yuan lacks a "long-term devaluation base," and that the yuan's exchange rate is stabilizing.

"Dwindling foreign reserves could also be seen as an adjustment mechanism," said Zhang.

Adjusting the management of its currency reserves is China's way of shifting toward a "new normal," as having excessive foreign currency reserves could harm the domestic economy, said Tan.