Companies have been flocking to the Qianhai area of Shenzhen, South China's Guangdong Province, since it was designated as part of the China (Guangdong) Pilot Free Trade Zone (FTZ) earlier this year. During a Global Times reporter's recent visit to Qianhai, company executives explained the advantages of setting up shop there. However, those advantages have lost some of their appeal as China's other FTZs have offered similar incentives, leading experts to call for more testing of financial liberalization in Qianhai.

Every day, dozens of people come to a makeshift office park created from 333 cargo containers on the western edge of Shenzhen, South China's Guangdong Province, to register their companies.

Surrounded by construction sites and overgrown lots, the government office complex was built in 2013 to process applications from companies registering in the Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone.

More than 100 companies now get registered in the complex each day, in a vivid illustration of what locals call "Shenzhen speed," which turned this former fishing village into a metropolis in just three decades.

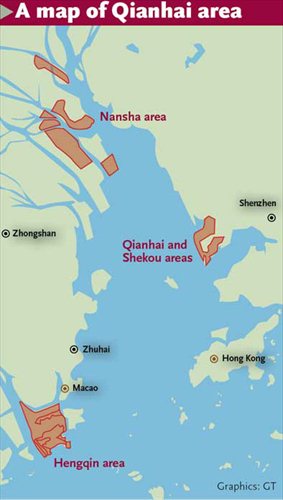

The 15-square-kilometer Qianhai zone is a pilot district designed to facilitate greater cooperation between neighboring Hong Kong and the mainland. China's authorities hope to use Qianhai as a testing ground to spearhead financial reform by taking advantage of its proximity to Hong Kong.

Development in Qianhai exploded after it became part of the China (Guangdong) Pilot Free Trade Zone on April 21. At the construction sites around the office park, laborers work continuously in the tropical heat. There are 10 construction projects slated to be completed over the next five months, including a shopping center for imported products and a wine trading center.

A total of 11,325 enterprises were registered in Qianhai between April 21 and July 20, triple the number of the same period in 2014, according to data from the Qianhai authorities. Those companies have a total registered capital of 497.37 billion yuan ($77.6 billion).

"Low financing costs, low labor costs and high efficiency have enticed a growing number of enterprises to set up operations in the zone," said Wang Jinxia, a spokesman for the Qianhai authority.

Three-day registration

Many Hong Kong-based investors are interested in setting up operations in Qianhai because of its location, simplified registration process and preferential policies, said You Lei, chief consultant of Tenbo International Business Co, an agency that drums up investment in the zone.

"It only takes three workdays to register a company in the zone, shorter than five to 20 workdays to get the registration outside the zone," You told the Global Times on Tuesday.

The Qianhai authority streamlined the company registration process for foreign investors on May 8. From then to the end of June, 317 foreign enterprises were registered in the zone.

The Qianhai zone has also offered preferential tax policies to overseas talent since 2013. Foreign professionals only have to pay a 15 percent personal income tax rate, the same as in Hong Kong. The individual income tax rate is as much as 45 percent on the rest of the mainland.

"Companies with a high percentage of overseas employees can save labor costs by setting up operations in Qianhai," Wang told the Global Times on August 5.

Qianhai plans to increase the proportion of skilled foreign workers in the zone's labor force from merely 0.76 percent in 2013 to 10 percent this year and to 20 percent in 2020, -according to the Qianhai authority.

Cheap credit

Cheap financing is another benefit of setting up in the Qianhai zone, several company executives said.

Qianhai was the first national experiential zone to pilot cross-border renminbi loans in 2011, allowing companies registered there to borrow in yuan from banks in Hong Kong, with some restrictions. The loans cannot be used to invest in securities, financial derivatives, wealth management products or investment properties.

"Our company will repay a cross-border 100 million yuan ($15.56 million) loan from a Hong Kong bank next week," Li Qingrong, an expert with Shenzhen ZTE Supply Chain Co, told the Global Times on August 5.

Li said the interest rates for cross-border yuan loans are lower than 4 percent, while the interest rates offered by mainland banks are around 5.5 percent.

As of the end of June, companies registered in Qianhai had borrowed nearly 30 billion yuan from the -offshore yuan market, according to data from the local authority.

"The program has created channels for offshore yuan to flow back to the mainland, a move to boost the renminbi's internationalization," said Zhou Zhongqing, general manager of Shenzhen Qianhai Jinglun Investment and Development Co.

Yuan deposits in Hong Kong increased by 2.1 percent month-on-month to 993 billion yuan as of the end of June, the highest level since the beginning of this year, data from the Hong Kong Monetary Authority showed on July 31.

A freer FTZ

Qianhai's advantage in low financing costs has been eroded as more free trade zones (FTZs) have granted access to cross-border renminbi loans. The pilot program for cross-border yuan loans was expanded to the Shanghai FTZ in February 2014, and to the other two areas of the Guangdong FTZ in July this year.

Companies in the Shanghai FTZ had borrowed 20.7 billion yuan in cross-border renminbi loans as of the end of March.

Cross-border loans totaling 1.27 billion yuan have been issued to enterprises registered in the Nansha and Hengqin areas of the Guangdong FTZ, data from the Guangdong Office of the China Banking Regulatory Commission showed.

The spread between onshore and offshore interest rates has also been shrinking, which makes cross-border loans less attractive, Zhou said.

China's central bank has cut interest rates three times since November, lowering the benchmark lending rate to 5.1 percent. Meanwhile, the offshore yuan's interest rate in Hong Kong has been rising due to rising overseas demand for the currency, such as for buying mainland stocks through the Shanghai-Hong Kong Stock Connect program, Zhou said.

Experts suggest Qianhai take bigger steps toward financial liberalization.

"Authorities should allow enterprises in the zone to convert yuan into foreign currencies without limits, monitor where the capital flows head to and test the impact of the yuan's fully convertibility under the capital account to the financial system," said Lin Jiang, a professor at Guangdong-based Sun Yat-sen University.