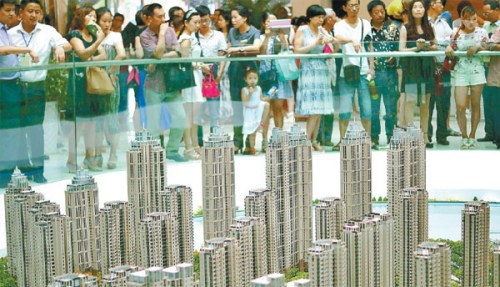

Realty prices continue recovery Potential buyers check out the model of a new housing project at a real estate firm in Yichang, Hubei province. Sales of new homes across 30 cities, monitored by E-house China R&D Institute, declined 5.5 percent in July. (Photo provided to China Daily)

New home prices in Chinese cities rose month-on-month in July for the third straight month, a private survey showed on Friday, reinforcing the upward trajectory since the second quarter.

Despite being a traditionally slack season, average home price in 100 cities rose by 0.54 percent month-on-month in July to 10,685 yuan ($1,715) per square meter, slightly slower than the 0.56 percent gain in June, the China Index Academy, a research unit of SouFun Holdings Ltd, said in a report.

The academy data showed new home prices strengthened from June in 46 of the 100 cities it monitored, down from 53 a month earlier, while the number of cities that saw declines rose to 53 from 46 in June.

The expansion in the number of price declines was, however, offset by the strong pickup in a few cities. Shenzhen again led the nation with a 9.73 percent month-on-month advance, even faster than the 6.58 percent growth in June. Average prices in Shenzhen are already a tad higher than a year earlier.

"Confidence in the property market is improving steadily and we expect continuous growth in sales and prices. But with the varying level of home inventory in different cities, the divergence between the large and small cities will persist," said the report.

The academy attributed the price hikes to a string of favorable policies, including the three straight interest rate cuts this year, favorable housing provident fund policies and removal of the earlier curbs on developers and homebuyers. More than 100 cities have adjusted their housing provident fund policies, making it easier to withdraw funds to buy homes.

Of the major 10 cities monitored, seven saw price increases. Besides Shenzhen, new home price in Beijing rose 1.49 percent over June and by 1.16 percent in Shanghai.

Prices of pre-owned housing in major cities, which respond more swiftly to changes in sentiment, grew in all the 10 major cities. Shenzhen again led the growth, with an 8.11 percent gain. Shanghai rose 1.82 percent and Beijing rose 1.2 percent.

Along with the robust price hikes, sales also blossomed, despite being an offseason.

Sales of new homes across 30 cities, monitored by E-house China R&D Institute, declined 5.5 percent in July over that of June. But the figure was still 44.2 percent higher than a year earlier, and was the highest July record in the past six years. In Beijing, sales rose by 24.7 percent from June and by 89 percent from July 2014.

Sales of Beijing's pre-owned homes in July (as of July 29) hit 19,304 units, and is very likely to surpass 20,000 units, according to Centaline Property Agency. There are only 13 months throughout Beijing's housing history when sales have exceeded 20,000 units.

In Shenzhen, a local court recently declared its first ruling on a housing sale contract violation. The plaintiff sued the home owner after he raised prices twice after the contract was signed. The owner wanted to hike the total unit price to 2.6 million yuan from 2.2 million yuan initially, and later to 3.1 million yuan, after the buyer accepted the first hike. According to Centaline, 60 percent of contracts have been revoked in Shenzhen since looser policies were introduced on March 30.

Yan Yuejin, an analyst with E-house, said: "After the consecutive monthly price hikes in big cities, the best opportunities to 'buy low' have passed. The third quarter is the next prime time to cash in before sales and prices start climbing in September, a traditionally boom period."