E-commerce sites cut search firm's profit as it spends to compete with rivals

Efforts by Baidu Inc to move deeper into online-to-offline (O2O) businesses have crimped its profitability, but the Chinese search engine company has no choice except to keep spending heavily to catch up with its rivals, analysts said on Tuesday.

In its unaudited second-quarter results released on Tuesday, Baidu reported revenue of 16.58 billion yuan ($2.67 billion), up 38.3 percent year-on-year. But operating profit fell 2.5 percent to 3.47 billion yuan.

The company said that higher costs of its O2O businesses and online video unit iQiyi reduced the operating margins by 25.3 percentage points and 5.1 percentage points, respectively.

Baidu also revealed for the first time the gross merchandise volume (GMV) for its O2O services including group-buying platform Baidu Nuomi, food delivery platform Baidu Waimai and travel website Qnar, which reached 40.5 billion yuan in total, a surge of 109 percent year-on-year. GMV measures the sales value of an e-commerce site.

According to Chairman and CEO Robin Li Yanhong, the company is ideally positioned to seize O2O opportunities. Analysts aren't so sure.

"In the medium to long term, Baidu's O2O businesses will require heavy investment, and it is hard to predict when Baidu can reduce that spending or when its group-buying site and other O2O sites will be financially independent," Wang Yaqian, an analyst with Beijing-based market research consultancy iResearch, told the Global Times on Tuesday.

It was only earlier this year when Baidu finally formulated a development strategy for its O2O services, Wang noted.

"Compared with Alibaba Group Holding Ltd and Tencent Holdings Ltd, Baidu is an obvious latecomer in diversifying into the O2O area," Li Yi, secretary-general of the China Mobile Internet Industry Alliance, told the Global Times on Tuesday. "Because of the time it has lost, the company lags behind its strong rivals in terms of recent financial results."

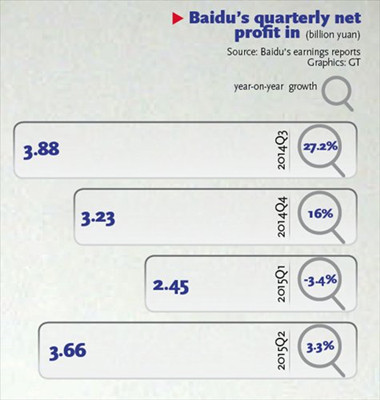

In the first quarter of this year, Alibaba and Tencent registered net profits of 7.74 billion yuan and 6.93 billion yuan, up 16 percent and 8 percent year-on-year, respectively. But Baidu's first-quarter profit fell 3.4 percent to 2.45 billion yuan.

"In a way, it is understandable that the company is stepping up investment to make up for lost time and market share," Li said.

It was only at the end of June that Baidu announced it would put 20 billion yuan into Baidu Nuomi over the next three years.

On Tuesday, Baidu's CEO announced in a meeting that Baidu Waimai, the food delivery O2O platform, and mobile app store 91 Wireless would be spun off for independent development. He also confirmed that Baidu Waimai had just raised $250 million in its latest round of financing.

"This is an interesting move," Wang said. It's not really feasible for Baidu to go private and depart from the US market as many other Chinese companies such as Focus Media have done, he said.

These companies have opted to be listed instead in the Chinese mainland. However, a spinoff could be an option for Baidu to have listings in several locations, Wang added.

Baidu's U.S.-listed shares on Tuesday were trading down about 16 percent by press time, its largest daily share price drop since 2008.

The company reported a net profit of 3.66 billion yuan, an increase of 3.3 percent year-on-year. It also forecast revenue of 18.17 billion yuan to 18.58 billion yuan in the third quarter, below the 18.79 billion yuan consensus estimate of analysts polled by Thomson Reuters.