Middle-class spending in Chinese mainland offers opportunity, says group chairman

Legend Holdings Corp, parent company of the world's largest PC maker Lenovo Group Ltd, bucked the declining market trend during its trading debut in Hong Kong on Monday.

The shares edged down 0.07 percent on Monday from HK$43.15 ($5.56) to HK$42.95 at the close, almost flat with the offering price of HK$42.98.

The benchmark Hang Seng Index, however, slid 2.61 percent or 696.89 points to close at 25,966.98, the lowest level since April 2.

The initial public offering, the third-largest in Hong Kong so far this year, was about 45 times oversubscribed on Friday. The company reaped net proceeds of HK$14.63 billion from the issue.

The company secured HK$7.37 billion worth of commitments from 24 cornerstone investors, including Hong Kong property and jewelry tycoon Cheng Yu-tung and developer Walter Kwok Ping-sheung

Investors from the Chinese mainland such as Fosun International Ltd, China Reinsurance (Group) Corp, China Development Bank Capital Co Ltd, TCL Corp, CITIC Ltd and the asset management arm of Industrial and Commercial Bank of China Ltd were also on the list.

Legendary Hong Kong businessmen Li Ka-shing and Lee Shau-kee as well as mainland Internet magnates Jack Ma of Alibaba Group Holding Ltd and Pony Ma of Tencent Holdings Ltd were said to have invested in the Beijing-based company.

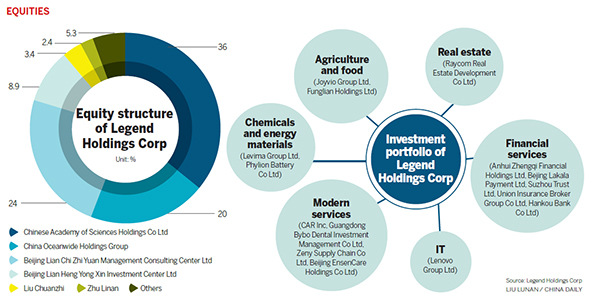

Apart from a 30.56 percent stake in Lenovo, Legend has made strategic investments in several other segments ranging from information technology and financial services to consumer services, agriculture, property, chemicals and energy.

The company's revenue has expanded at a compound annual growth rate of 13.1 percent from 226.32 billion yuan ($36.45 billion) in 2012 to 289.48 billion yuan in 2014. Net profit grew 34.8 percent annually during the same period to 4.16 billion yuan last year.

"Consumption is the opportunity in China," said Liu Chuanzhi, founder and chairman of the company. "The country's middle class has become bigger than the combined population of many European countries, which generates huge demand that needs to be met.

"Sectors such as healthcare, previously restricted to private investors, now have huge room to grow. In other sectors such as travel and transportation, the Chinese are inspired by the examples of foreign countries to improve quality of life," he said.

Zhu Linan, president of Legend, said on the sidelines of the listing ceremony: "Apart from consumption, finance and other modern services, we will continue to invest in 'cool', high-quality businesses. We are embracing the opportunities of the Internet era."

He noted that the company already has eloancn.com, a peer-to-peer lending platform, and Joyvio Group Ltd, a producer and online vendor of fruit.

"We are also looking for valuable investment targets worldwide, which presumably can offer synergy with our investments in China and generate organic growth," Zhu said, adding that the company's European branch is exploring the financial sector.

"We're also looking into international opportunities ... We bought a farm in Chile, and the products are already available at our online platform," he said.