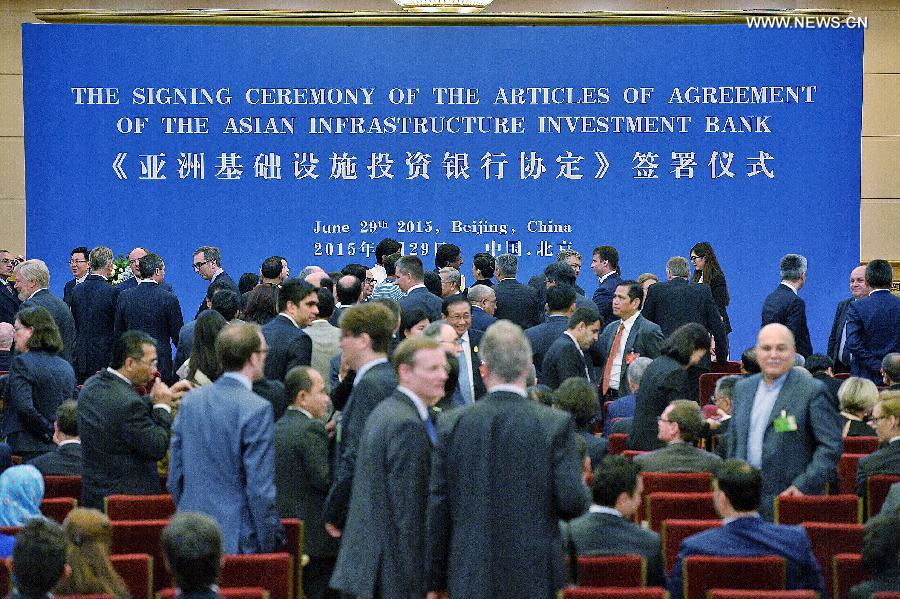

Representatives of prospective founders of the Asian Infrastructure Investment Bank (AIIB) prepare to attend the signing ceremony of the articles of agreement of AIIB in Beijing, capital of China, June 29, 2015. (Photo: Xinhua/Li Xin)

A China-initiated multilateral bank that has dominated media headlines for months took a key step forward on Monday, with the signing of an agreement that outlines the framework and management structure for the institution.

Representatives of the 57 prospective founding countries of the Asian Infrastructure Investment Bank (AIIB) gathered in Beijing for the signing ceremony in the Great Hall of the People. Australia was the first country to sign the document.

The 60-article agreement specified each member's share as well as the governance structure and policy-making mechanism of the bank, which is designed to finance infrastructure in Asia.

Seventy-five percent of the bank's share is distributed among Asian and Oceanian countries while the remaining 25 percent is assigned to countries outside the region. As the bank expands its membership, countries outside of the region can expand their stake, but the portion cannot exceed 30 percent. Each member will be allocated a share of the quota based on the size of their economy.

China, India and Russia are the three largest shareholders, taking a 30.34 percent, 8.52 percent, 6.66 percent stake, respectively. Their voting shares are calculated at 26.06 percent, 7.5 percent and 5.92 percent.

China's stake and voting share in the initial stage are a "natural outcome" of current rules, and may be diluted as more members join, China's Vice Finance Minister Shi Yaobin said in an interview with Xinhua.

"China is not deliberately seeking a veto power," Shi stressed.

Being the largest shareholder does not mean China will have veto power over major issues. Instead, China will closely watch and balance other members' interests, said Tang Min, with Counselors' Office of the State Council, who previously worked for the Asian Development Bank (ADB).

Speaking at Monday's ceremony, Finance Minister Lou Jiwei said the new bank will uphold high standards and follow international rules in its operation, policies and management to ensure efficiency and transparency.

The bank, headquartered in Beijing, will possibly set up regional offices in other countries. It will be led by a president with a five-year term that can be extended once.

The articles do not say who will be the president, but said the president will be chosen from Asian member countries using an "open, transparent and excellent" selection process.

Jin Liqun, former vice finance minister of China, is secretary-general of the interim multilateral secretariat for establishing the AIIB.

After signing the agreement, representatives from prospective founding countries will return home with the document for legal adoption.

The AIIB was proposed by President Xi Jinping in October 2013. A year later, 21 Asian nations, including China, India, Malaysia, Pakistan and Singapore, signed an agreement to establish the bank.