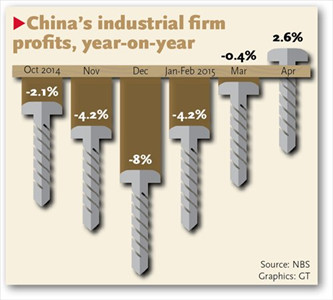

China's major industrial enterprises saw year-on-year growth in their total gross profits in April, reversing a six-month decline since October, partly due to high investment returns in the capital markets, the National Bureau of Statistics (NBS) said on Wednesday.

Major industrial enterprises - companies whose annual revenue is at least 20 million yuan ($3.23 million) - saw their total gross profits climb 2.6 percent year-on-year to 479.5 billion yuan in April, the NBS said in a statement on its website.

He Ping, an NBS statistician, attributed the increasing profits to a rise in industrial production as well as industrial sales, which helped the enterprises' main business revenues to rise 0.6 percent year-on-year in April, according to a separate statement on the NBS website.

The rise in profits was also partly due to the government's monetary easing policies in recent months, as such policies have helped reduce costs for industrial enterprises, He said.

The People's Bank of China (PBC), the central bank, has cut benchmark interest rates three times since November, in a bid to prevent an excessive slowdown in the country's economic growth.

As a result, domestic industrial enterprises' interest payments rose by 1.5 percent year-on-year in April, 1.5 percentage points lower than that in the first quarter of this year, according to He.

Private industrial enterprises have demonstrated strong market performance in recent months, with their gross profits climbing 6.1 percent year-on-year to 610.54 billion yuan in the first four months of 2015, while the profits of State-owned industrial enterprises fell by 24.7 percent during the same period, data from the NBS showed.

Lu Zhengwei, chief economist at Industrial Bank Co, told the Global Times on Wednesday that profits for State-owned industrial enterprises have been hit by sluggish market demand from domestic heavy industries, such as oil and steel, because the main businesses of many State-owned industrial enterprises are in these sectors.

Lu also noted that private industrial enterprises are more likely than State-owned enterprises to get involved in the flourishing capital markets, such as trading in futures or stocks, in an effort to boost their profits.

The earnings from such investment activities, including gains from stocks and bonds, have contributed significantly to profits for certain industrial enterprises in April, such as companies in the liquor and equipment manufacturing industries, He said in the statement.

According to the NBS, Chinese industrial enterprises' gross profits increased by 12.03 billion yuan in April from a year earlier, among which investment returns contributed 11.61 billion yuan.

But experts said that industrial enterprises should pay close attention to potential financial risks, since many of them are taking a high-risk approach to investment in a bid to increase their profits.

Sun Lijian, vice dean of the School of Economics at Fudan University, told the Global Times on Wednesday that private industrial companies should be even more watchful about their investments than State-owned enterprises.

"While the government might help address the financial risks of State-owned enterprises, private companies must take the consequences of any failed investment by themselves," said Sun.

However, Lu noted that China's flourishing capital markets have improved the financing conditions for domestic industrial enterprises, which in turn can benefit their businesses.

Of the 41 industries monitored by the NBS, 30 of them such as textile and chemical sectors saw their profits climb year-on-year in the first four months of 2015, while 10 saw their profits decline, including the coal, oil and auto sectors.

The energy industry showed downward trends, with profits for oil and nuclear fuel processing industries slumping nearly 100 percent year-on-year in the first four months of 2015. The coal mining industry also saw its profits decrease by 61.6 percent year-on-year during the same period.

Lu said that the domestic energy industry should see an improvement along with China's economic recovery in general.

The NBS also noted that although China's major industrial enterprises saw their profits increase in April, factors such as sluggish demand and falling product prices will continue to affect their profit growth.