Chinese brands, in particular, had a strong start to the year, with year-on-year growth in light vehicle sales in year-to-date terms reaching 12 percent, in contrast to the 6 percent year-on-year growth in the overall light vehicle market. Even when allowing for China Association of Automobile Manufacturers' definition of the passenger vehicle segment - which removes the effect of the volume transfer from the Mini Bus segment to the MPV segment - Chinese-branded models' year-to-date share reached 43 percent, pointing to a sizeable improvement from the 38 percent seen in the same period of last year.

Within the thriving SUV segment, year-to-date sales of Chinese-branded models amounted to 460,000 units, double the volume achieved in the same period of last year. It is also worth noting that this volume exceeds that of all locally-made foreign-branded SUVs put together, sales of which increased only modestly to 360,000 units, an 8 percent increase in year-on-year terms.

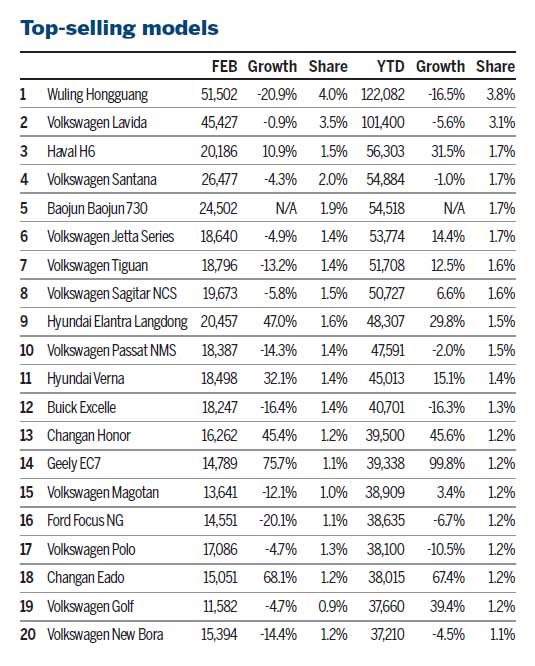

Among the top 10 bestselling SUVs, seven were Chinese-branded models, led by the stellar performance of the Haval H6, which saw sales of 56,300 year-to-date. The boom in the segment has prompted Chinese Original Equipment Manufacturers, or OEMs, to accelerate the launch of SUV products into the market as evidenced by the introduction of as many as six new models over the last twelve months among the top ten most popular Chinese-branded SUVs.

When taking into account the flat trend seen in the car segment for both Chinese and foreign brands, it becomes evident that the flourishing SUV segment has helped Chinese brands stave off the pressure from the downward extension of foreign-branded cars.

More significantly, on the competitive frontier, Chinese brands have established a solid position in the 100,000 yuan ($16,393)-plus price range with their SUV products, thanks to the gap in the price band left by foreign marques. Looking ahead, the Chinese OEMs skilled at product development, such as Great Wall Motor and Changan Automotive, are set to expand their price ranges to exceed 150,000 yuan or even as much as 200,000 yuan, underpinned by the ease with which they are able to penetrate the segment.

The upshot of this dynamic trend in the SUV segment is that, over the next few years, Chinese OEMs will not only benefit from a time window in which to hone their product development skills, but will have the means to penetrate the market at a higher level. In short, Chinese OEMs now have a renewed strategic opportunity to excel, which must be maximized in order to prevent history from repeating itself, when foreign rivals flooded the market with lower-priced products, leaving their domestic counterparts with no means of defence.

(Note: Since January 2015, LMC Automotive has followed the China Association of Automobile Manufacturers to classify the Wuling Hongguang and Changan Honor in the MPV [PV] segment, while the minibus segment is still defined as an LCV.)