US law firms, regulator launch separate probes

Two US securities law firms over the weekend launched investigations on Youku Tudou Inc over whether it issued "false and misleading" statements to investors, following the leading Chinese online video company's disclosure of a larger fourth-quarter loss.

Bernstein Liebhard LLP said in a press release on Saturday Beijing time that the company only gave investors two days to prepare for its earnings announcement, which was issued on Thursday and recorded a large net loss for the fourth quarter.

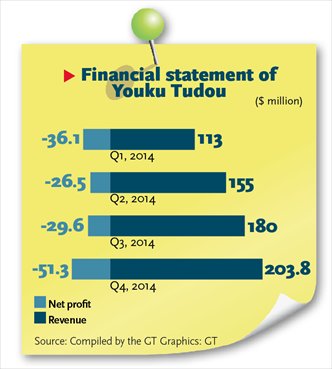

According to the announcement, Youku Tudou had a 318.1 million yuan ($51.3 million) net loss during the fourth quarter, a huge increase from the previous year's net loss of 24.6 million yuan. The earnings report also revealed that the US Securities and Exchange Commission (SEC) is investigating aspects of Youku Tudou's past accounting, which Youku Tudou said is a routine review.

The news aroused investors' concerns about whether the Chinese company had violated US federal securities laws and dragged down the company's shares on the New York Stock Exchange by more than 10.89 percent, closing at $13.5 on Friday, said Bernstein Liebhard LLP, which is investigating Youku Tudou on behalf of investors.

Another US law firm Pomerantz LLP also filed a similar investigation on Saturday, according to a press release seen on Saturday Beijing time.

Youku Tudou could not be reached for comment on this by press time.

The investigation from the SEC and local law firms on Youku Tudou is not a surprise, as US-listed Chinese enterprises usually made themselves an easy target by not strictly following US regulations as a result of cultural differences, Fu Liang, a Beijing-based IT expert, told the Global Times Sunday.

He noted that some US securities law firms seem to be relying on filing class action lawsuits against Chinese Internet companies on behalf of investors.

Law firm Pomerantz LLP said on Friday that it has filed a class action lawsuit against China's e-commerce giant Alibaba Group Holding over complaints that the company issued materially false and misleading statements regarding the strength of its financial prospects and regulatory scrutiny in its home market.

Fu said that investigations are positive in that it could further help regulate the information disclosure and management of Chinese enterprises.

Fu's opinion was echoed by Zhang Yi, CEO of Guangzhou-based iiMedia Research.

Both analysts were concerned that the SEC investigation and potential lawsuits will dampen the confidence of investors in the US stock market in Youku Tudou.

Some overseas rating teams have already downgraded Youku Tudou's shares.

The rating section of US online media outlet TheStreet Inc also rated the company as a "sell," saying in a report posted on the site late on Friday that the downgrade is driven by the company's weakness in multiple areas such as its poor profit margins and weak operating cash flow.

And Deutsche Bank on Friday reportedly downgraded the company's shares from "hold" to "sell" and slashed its price target to $10.9 from $18.6, citing the company's shrinking market share in the face of fierce competition in its main market.

A report by Beijing-based market research firm Analysys International showed in December that although Youku Tudou led the Chinese online video providing market by revenues in the third quarter of 2014, its market share was being reduced by rising players such as Sohu Inc's video site tv.sohu.com and Tencent Holdings' online video arm v.qq.com, falling to 22.82 percent during the quarter from the previous quarter's 24.45 percent.

Tencent's video arm jumped to fourth with a 10.67 percent share of the market from 9.6 percent in the second quarter.

While Tencent's popular messaging app WeChat can be a boon for the enlargement of its online video audiences, Youku Tudou needs to invest more money and efforts in purchasing high-cost content to maintain user loyalty, Zhang told the Global Times Sunday, noting that he is worried about the prospects of Youku Tudou.

Besides fierce competition, Youku Tudou is also faced with unclear domestic regulations and an immature business model, said Fu.

"Advertising incomes, a main contributor to online video companies' revenue, can hardly be something sustainable enough to offset the content and bandwidth costs," said Fu.

Alibaba's strategic investment in Youku Tudou in April 2014 appears to be something that the video streaming company will bank on to help diversify its business model.

Analysts, however, noted that the deal will not likely benefit Youku Tudou significantly except as financial support, unless online video viewers develop the habit of shopping while watching videos.

Youku eyes profit in 2015 with new tools

2014-12-11Youku Tudou expects mobile income growth, trials e-commerce program

2014-11-20Xiaomi, Youku Tudou agree video content cooperation

2014-11-13Youku on prowl for original content in US

2014-10-28Youku Tudou comes up with smartphones

2014-08-18Youku teams with Shanghai to build film production center

2014-06-20Youku Tudou tries to grab late-night audiences

2014-06-19Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.