Industrial output growth drops to slowest pace since February 2009

China's economy fell to its lowest level of growth since the 2008 global financial crisis in the first two months of the year, and is still being hurt by weaker demand and excess industrial capacity.

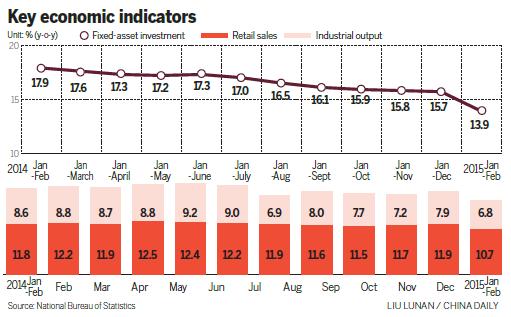

The National Bureau of Statistics reported on Wednesday that industrial output growth year-on-year dropped to 6.8 percent in January and February, the slowest pace since February 2009, compared with 7.9 percent in December, the direct result of overall declines in factory production, fixed-asset investment and retail sales.

Economists said they now expect further policy easing in the coming months to ensure that GDP growth does not fall below the government's recently announced target of "around 7 percent" for this year.

Fixed-asset investment, which used to be the strongest driving force of the world's second-largest economy, slowed to 13.9 percent in the first two months from the whole-year growth rate last year of 15.7 percent, its lowest level since December 2000.

Slightly more encouraging were retail sales which increased by 10.7 percent in January and February from the same period last year. However, that was still slower than the 11.9 percent rise in December, and marked the weakest growth since March 2006.

"The downward pressures on growth, stemming from the weakness in real estate, will remain in the coming months," said Louis Kuijs, chief economist in China at Royal Bank of Scotland Plc.

"We expect a further 50-basis-point cut in benchmark lending and deposit interest rates, probably in two steps, with the first step in the second quarter."

Kuijs also expected that quantitative monetary management will continue to be key in steering monetary conditions this year, and managing the growth of base money is part of that.

"There are downside risks to infrastructure spending this year. However, we do not share the fears about a 'fiscal cliff' that some observers have, with local government spending coming down sharply because of the constraints of the new local government debt framework," he said.

Liu Ligang, chief economist in China with Australia and New Zealand Banking Group Ltd, said that the government could accelerate the approval of infrastructure construction projects following the ongoing two sessions, and announce further monetary easing measures.

"A targeted, moderate stimulus package may be seen in future to curb the economic slowdown," he said.

Premier Li Keqiang has lowered 2015's GDP target to around 7 percent, down from last year's 7.5 percent. Last year, annual economic growth was 7.4 percent, or a 24-year low.

Xu Shaoshi, minister of the National Development and Reform Commission, said at a news conference at the annual National People's Congress session that the economy had actually rebounded slightly in February after the deepened downturn in January.

"Some leading indexes, such as the Purchasing Managers Index, have shown slight improvements, indicating stable market expectations and rebounded confidence, which will have a positive effect on future economic growth," he said.

In terms of month-on-month growth, industrial output accelerated by 0.45 percent in February from January, and fixed-asset investment improved by 1.03 percent, according to the NBS.

CPI inflation picked up in February to 1.4 percent year-on-year, mainly because of a rise in food prices. The PPI decline deepened from 4.3 percent in January to 4.8 percent in February, the NBS showed.

The manufacturing PMI climbed to 49.9 in February from 49.8 in January, but still showed contraction in the sector.

The central bank has cut benchmark interest rates twice since November. It also reduced the amount of cash that banks must hold as reserves in early February, in order to increase market liquidity and offset the increase of capital outflows.

China reports lower-than-expected output, investment data

2015-03-11Key figures for China‘s 2015 economy grab world attention

2015-03-11Expansion rate of energy consumption set to slow

2015-03-05China‘s manufacturing PMI rebounds in February

2015-03-02Factory activity edges back into expansion zone

2015-02-26China sees spike in inbound, outbound investments

2015-02-16China‘s foreign trade tumbles 10.8 pct in Jan

2015-02-09Factbox: China‘s 2014 economic figures

2015-01-20Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.