Data reflects economic transition: experts

China saw a current account surplus but a deficit in the capital and financial account in 2014, official data showed Tuesday, which experts said reflected China's economic transition.

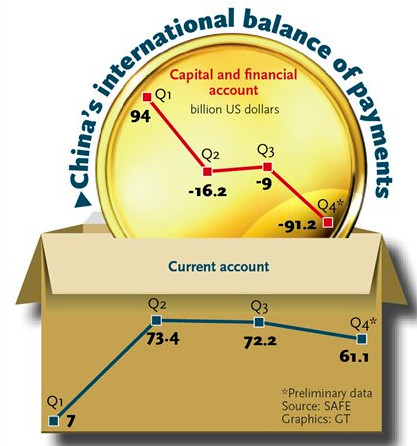

For the whole of 2014, China had a current account surplus of $213.8 billion and a $96 billion deficit in its capital and financial account, data from the State Administration of Foreign Exchange (SAFE), the country's foreign exchange regulator, showed Tuesday.

In the fourth quarter of 2014, China posted a current account surplus of $61.1 billion and a $91.2 billion capital and financial account deficit, SAFE said.

The sum of the capital and financial account figures in the four quarters does not match the data published on SAFE's website, according to Global Times calculations, but the SAFE figures are preliminary and subject to revision.

The country saw surpluses in both accounts from the final quarter of 2012 until the first quarter of 2014.

Experts said the change reflected China's economic transformation and that it could herald a new pattern for the future.

"The deficit in the capital and financial account has a positive side as it will provide long-term foreign exchange support for Chinese enterprises starting ventures abroad," analysts with Minsheng Securities said in a research note e-mailed to the Global Times on Tuesday.

Big strategic moves such as the "One Belt, One Road" initiative, along with rising capital outflows and companies investing abroad will change the norm of China posting a surplus in both the current account and capital and financial account, the research note said.

On October 30, 2014, a senior SAFE official said China wanted to reach a state whereby it recorded a current account surplus and capital account deficit, adding that the market should not overreact to such a change.

Fluctuations in cross-border capital flows and two-way fluctuation of the yuan could be a normal phenomenon in the future, the official said.

China has seen a deficit in its capital and financial account since the second quarter of 2014, which registered a deficit of $16.2 billion, while the third quarter saw a deficit of $9 billion.

Zhang Ning, a research fellow with the National Academy of Economic Strategy at the Chinese Academy of Social Sciences, said the status of the two accounts reflected China's current developmental stage.

Excessive currency holdings could pose a risk and China should diversify its assets, Zhang noted.

Zhang said the deficit in China's capital and financial account is mainly due to outflows of foreign speculative capital and strong growth in outbound direct investment (ODI).

China had a net capital outflow in 2014, a spokesman for the Ministry of Commerce said on January 19.

China's ODI into non-financial sectors stood at $102.9 billion for the whole of 2014, up 14.1 percent year-on-year, while foreign direct investment (FDI) into non-financial sectors in -China totaled $119.6 billion, increasing 1.7 percent from 2013.

But taking profit reinvestment and investment via third countries into account, China's ODI in 2014 was higher than the FDI, the spokesman said.

Zhang said that when the yuan depreciates, it is likely to be dropped by international speculators.

"In the second round of the yuan's depreciation against the US dollar near the end of 2014, the Chinese stock market was at its most bullish state in seven years. This prompted international speculative investors to cash in and leave China," Zhang told the Global Times Tuesday.

The yuan saw two prolonged periods of depreciation against the US dollar in 2014, the first one lasting from January to June, and the second one running from November to December.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.