'New normal' sees low inflation, stable employment

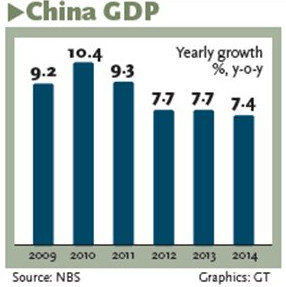

China's economic growth decelerated to a 24-year low of 7.4 percent in 2014, official data showed Tuesday, but the quality of growth has improved with enhanced productivity, low inflation and stable employment, analysts have said.

GDP expanded by 7.4 percent year-on-year in 2014, down from 7.7 percent in 2013, the slowest since 1991, data from the National Bureau of Statistics (NBS) showed Tuesday.

Analysts said this is the first time China has missed an annual growth target since 1998. But Ma Jiantang, head of the NBS, said the reading is still in line with the central government's target of "around 7.5 percent" for 2014, which was announced in the 2014 government work report in March.

Growing at 7.4 percent while keeping annual inflation at 2 percent and adding 13.22 million jobs is no mean feat, Ma told a press conference held Tuesday in Beijing.

"The 7.4 percent suits China's 'new normal,' with a shift from high-speed growth to medium-to-high speed growth. [2014's growth] was within a reasonable range and not low compared with other economies," he said.

The economic slowdown is within market expectations, led by slower investment growth in the real estate and manufacturing sectors.

Annual fixed-assets investment growth fell to 15.7 percent in 2014 from 19.6 percent in 2013, which Ma attributed to authorities' efforts to rein in overcapacity and cool down an overheated property market.

Some said the market should not focus too much on the falling of the GDP growth rate.

"It is not a drastic slowdown, and the improvement in China's economic structure is a bright spot, with domestic consumption and the services sector playing an increasing role in driving the economy," Wang Jun, an economist at the China Center for International Economic Exchanges (CCIEE), told the Global Times.

Consumption contributed 51.2 percent of GDP growth last year, up 3 percentage points over a year earlier. The services sector represented 48.2 percent of China's GDP in 2014, up 1.3 percentage points from that in 2013, according to the NBS.

Wang noted that the country's income distribution has also become more equitable. China's Gini coefficient, an index reflecting the income gap between the rich and the poor, dropped for the sixth consecutive year to 0.469 in 2014 from a peak level of 0.491 in 2008, according to the NBS.

Looking ahead, Ma said China's economy will maintain moderate to high-speed growth in 2015. As for this year's official growth target, he said it will be unveiled during the annual two sessions held in March.

Economists expect policymakers will focus more on structural reforms than the economic growth rate.

"Chinese authorities will likely tolerate a slower growth rate at around 7 percent under the framework of a 'new normal' economy and will strike a balance among social, environmental, and economic targets," Liu Ligang, chief China economist with ANZ Banking Group, said in a research note sent to the Global Times.

To achieve a growth target of around 7 percent for 2015, the central government will have to loosen monetary policy further, with an interest rate cut in the second quarter and one 50 basis points cut in the reserve requirement ratio in each quarter of 2015, analysts from Nomura Securities wrote in a note.

"Downward pressures still exist in the economy, including slowing investment in the real estate sector, but the implementation of some significant strategies, such as the 'One Belt and One Road' plan, will help boost infrastructure investment and foreign trade," said Wang from CCIEE.

He remains optimistic about China's economic outlook.

"China's economic growth will further slow at a moderate pace but still above 7 percent in 2015," he said. "A hard landing is unlikely."

NBS's Ma also noted that China will continue to minimize risks from the property sector and local government debt.

"China's growth remains riskily reliant on the expansion of credit," Andrew Colquhoun, head of Asia-Pacific Sovereigns with Fitch Ratings, said in a statement sent to the Global Times Tuesday.

"It will likely take faster progress on structural reform to create space for a form of growth and jobs creation that does not add to China's systemic vulnerabilities," Colquhoun said. "The onus is on structural reform to break the economy out of the trade-off between leverage and unemployment."

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.