New home sales in 70 major cities recorded the highest month-on-month growth of 2014 in December, boosted by the central bank's interest rate cut and property developers' year-end promotions, a statistics official said Sunday.

The sales volume of new homes rose by nearly 9 percent in December from November, mainly due to adjustments in mortgage policies, the cut in interest rates and developers' efforts to reduce their inventories, Liu Jianwei, a senior statistician with the National Bureau of Statistics (NBS), said in a statement posted on the bureau's website.

Sales of new homes in four top-tier cities - Beijing, Shanghai, Guangzhou and Shenzhen - all rose by more than 15 percent month-on-month in December, higher than the average level in the 70 major cities, according to Liu.

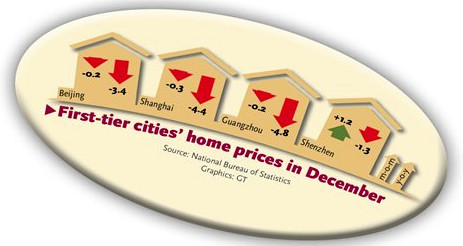

In terms of prices, fewer cities saw a fall last month. Of the 70 large and medium-sized cities monitored by the NBS, 66 cities saw new home prices drop in December from the previous month, down from 67 cities in November.

Home prices in three cities - Zhengzhou, Wuhan and Ganzhou - were unchanged in December. Shenzhen was the only one among the 70 cities that saw a rise in prices, with a 1.2 percent increase in December month-on-month, according to the NBS.

Liu said the extent of the decline in home prices had also narrowed. The average prices of new homes and existing homes in the 70 cities fell by 0.2 percent and 0.3 percent on a monthly basis in December, down from 0.4 percent and 0.5 percent in November, according to Liu.

"China's property market is on the path to recovery," Yan Yuejin, a researcher with Shanghai-based E-House China R&D Institute, told the Global Times Sunday.

"Existing home prices in the four top-tier cities all gained on a monthly basis in December, also signaling the improved market sentiment," Yan said.

China's once-heated real estate market has slowed down since early 2014, pushing many cities to relax property curbs in the second half of the year to revive the market.

"Home prices have showed signs of differentiation," Liu said, with the average home prices in first-tier cities witnessing month-on-month gains while lower-tier cities are still seeing drops in home prices, but at a slower pace.

Xie Yifeng, an expert with the National Real Estate Manager Alliance, forecast that both home sales volume and prices will pick up in 2015, with first-tier cities leading the recovery.

"But the real estate industry still faces three main risks: high inventories of unsold apartments, high costs of acquiring land and high borrowing costs," he told the Global Times on Sunday.

The average price of land for residential homes was 5,277 yuan ($850) per square meter in the fourth quarter of 2014, up 0.69 percent from the previous quarter, data from the Ministry of Land and Resources showed on Thursday.

Others are less optimistic, saying the housing market in China will remain weak in 2015 because of slower economic growth, excess housing supply, and banks' reluctance to lend to developers.

"The fundamentals of the property market have not changed. In most cities, reducing inventories remains the main task for local property markets this year," Zhang Hongwei, research director at Shanghai-based property consultancy ToSpur, said in a research note on Sunday.

Chinese property developers need about three years to clear inventories of unsold apartments, according to an estimate by the Shenzhen World Union Properties Consultancy.

China's real estate market is not likely to repeat the explosive growth seen in previous years, news portal chinanews.com reported Sunday, citing Mao Daqing, executive vice president at China Vanke Co, the country's largest residential developer in terms of sales.

The number of potential home buyers will also decrease as China's population is projected to peak, Mao said, adding that the pace of urbanization is slowing and there are still large inventories of unsold homes.

Decline in housing prices continues to level off

2015-01-19China home prices fall in December

2015-01-18Home prices continue downward slide in Nov

2014-12-19Home prices continue to cool in Nov

2014-12-18Property sector, farewell to ‘golden era‘

2014-12-31Post-1990 generation less likely to own property

2014-12-25China plans property tax in 2017

2014-11-03Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.