Economists expect additional monetary easing to spur growth

China's new banking lending hit a record high in 2014, but total social financing weakened and the money supply growth missed the central government's target, official data showed Thursday, raising economists' expectations for further monetary easing ahead.

Chinese banks issued 9.78 trillion yuan ($1.58 trillion) worth of new yuan-denominated loans last year, up from 8.89 trillion yuan in 2013 and reaching a record high, data from the People's Bank of China (PBOC), the central bank, showed Thursday.

China's credit structure has been improving and China's liquidity was relatively abundant in 2014, Sheng Songcheng, director of the PBOC's statistics and analysis department, told the Xinhua News Agency.

However, newly added yuan loans reached 697.3 billion yuan in December, well below market expectations and down from 852.7 billion yuan in November, according to the PBOC.

"The slowdown of new loan extensions in December suggests that China's commercial banks are still concerned about credit risks in traditional sectors," Liu Ligang, chief China economist at ANZ Banking Corporation, said in a research note sent to the Global Times Thursday.

China's total social financing - a broad measure of liquidity in the economy including bank loans, corporate bonds and equity financing - amounted to 16.46 trillion yuan in 2014, down from 17.29 trillion yuan in 2013, the central bank data showed.

"The decline is a result of China's economic slowdown and authorities' stricter regulation of shadow banking," Xu Hongcai, director of the Department of Information under the China Center for International Economic Exchanges (CCIEE), told the Global Times Thursday.

Analysts with the Bank of Communications (BoCom) said Thursday that China's industrial structure adjustment, especially slowing in the manufacturing and real estate sectors, is behind the slowing in the growth of total social financing. Both areas require substantial financing, analysts said.

But social financing activities have showed signs of stabilizing, with the amount of total social financing rising to 1.69 trillion yuan in December from 1.15 trillion yuan in November.

"The central bank's cut in the interest rates in late November and a batch of pro-growth policies have boosted corporate financing demand," BoCom said in a research note sent to the Global Times Thursday.

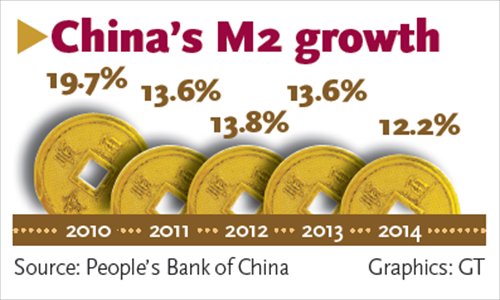

M2, a broad measure of money supply that covers cash in circulation and all deposits, grew by 12.2 percent year-on-year to 122.84 trillion yuan by the end of December, missing the central government's target of 13 percent for 2014.

The slowdown in money supply expansion was caused by slower growth in bank deposits and a drop in Chinese banks' forex purchases, according to BoCom's analysts.

Banks have been facing competition from online monetary funds, including Alibaba's Yu'ebao, that offer higher investment returns. According to the PBC, new yuan-denominated deposits amounted to 9.48 trillion yuan in 2014, a surprising decline from 2013's 12.56 trillion.

The central bank said Thursday that it will continue to implement prudent monetary policy in 2015 while focusing on targeted macro-control measures and monetary conditions that are "neither too tight nor too loose."

The PBOC will maintain appropriate liquidity, and guide credit supply and seek steady, moderate growth in social financing, read a statement posted Thursday on its website.

Economists widely expect further monetary easing to spur economic growth, which think tanks and investment banks expect to fall to around 7 percent in 2015.

Xu from CCIEE suggested that Chinese policymakers raise the M2 growth target to between 13 and 14 percent for 2015.

"A higher M2 growth will stimulate economic growth and without causing inflationary pressure," Xu said.

"As the economy continues to slow and the risk of deflation looms large, we expect monetary policy to ease further," said Liu from ANZ.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.