Intended as adjustment to global low price, but raises concerns in Heilongjiang Province

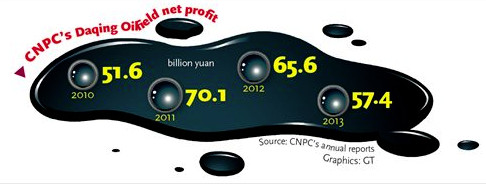

Experts say a production target cut in Daqing Oilfield, a major domestic oil field, will be helpful for the company to make structural adjustments while the global crude oil price remains at a record-low.

Daqing Oilfield, the crown jewel of China's largest oil and gas producer and supplier by output China National Petroleum Corporation (CNPC), is reportedly having its production target trimmed down gradually from the current 40 million tons per year to 32 million tons per year by 2020.

Daqing, which accounts for nearly one-quarter of China's domestic inland oil production, will cut its annual output target by 1.5 million tons in 2015, starting on a track of downsizing annual output by 1.3 million tons on average in a time span over six years, the Xinhua News Agency reported on Sunday, citing a provincial-level economic work conference in Northeast China's Heilongjiang Province.

Experts said the output target cut for Daqing Oilfield will win CNPC some time to make relevant deployments to position itself into a relatively advantageous position against the backdrop of the current supply-demand dynamics in the global crude market.

"Maintaining a high production level had been the predominant task when crude oil prices were high, but such task is less pressing for oil field operators now, as the global crude price has been at its lowest in decades," Yu Qing, a senior energy analyst with Shanghai-based CBI Research Center, told the Global Times Sunday.

The global crude oil price has been at a record-low with Brent crude lingering at around $65 per barrel in December, with OPEC's decision to not lower its output to retain its market share and test the nerve of US shale producers.

Daqing has been vigorously producing crude at the high level of around 40 million tons per annum for almost 40 years and is currently facing the prospect of -resource-depletion, the Xinhua report said.

A slower development pace gives CNPC time to adjust and consolidate the "soft" aspect that affects oil production, such as talent building and adjusting the operating method, which extends the oil field's potential to boost output when the oil price starts to rise again, Yu said.

Some of the production units are directly owned by CNPC while others are outsourced and there is a gap between the two types of units in terms of the applications of new technologies, according to experts.

Daqing, China's largest inland oil field, has produced more than 2.1 billion tons of crude oil since production started in 1960, Xinhua reported.

However, there are concerns that the lowered output will affect the lives of people in the surrounding Daqing city and even Heilongjiang Province, which relies heavily on the oil field in terms of fiscal revenues and is facing a growth bottleneck.

"The immediate impact of the production cut will fall on companies that do business centered on oil production, for instance, those who supply materials to the oil field to make a profit. In the long term, much broader aspects of community life in Daqing will be affected due to a drop in household income," a resident of Daqing surnamed Han, who declined to be named, told the Global Times Sunday.

Daqing accounted for 90 percent of the energy sector in Heilongjiang and the province's GDP will be reduced by 20 billion yuan ($3.2 billion) and fiscal revenues by 6 billion yuan due to Daqing's output cut in 2015, the Xinhua report said, citing preliminary estimates.

Daqing is expected to produce 40 million tons of crude oil this year.

Heilongjiang Province has suffered economic problems as its growth rate was the lowest among 31 China's provincial-level regions in the first half of the year. Heilongjiang's GDP expansion decelerated to 4.8 percent in the first half of 2014 from the high point of 9 percent in the first quarter of 2013.

To offset the downside of the output cut, Heilongjiang plans to deepen cooperation with CNPC in 2015, and vowed to expedite several refinery and petrochemical projects in Daqing.

But Han said many of the petrochemical projects that are already in place are not doing well.

"A lack of consideration of product circles means products hit the market at the wrong time when commodities price are low and product quality issues in refining grade mean low sales despite overall strong market demand," Han said.

"In the short term, prices of petrochemical products are also weighted down by the current supply glut and low demand, so the benefit will be limited," Yu said. "But spreading across the industrial value chain will give Daqing more ability to withstand a sudden price drop for any single end product in the long run."

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.