Drops seen in both revenue, profit

Traditional brick-and-mortar retailers in China are expected to continue suffering slow growth in revenue and profit for the entire year of 2014, said a partner with a global leading accounting firm PwC China on Thursday.

At the release of a research report on the performance of retailers in China, Kevin Wang, a retail specialist at PwC China, said that China's retailing industry in 2014 is still undergoing adjustment, a reflection of the nation's tepid economy, copying the stagnant performance in the second half of 2013.

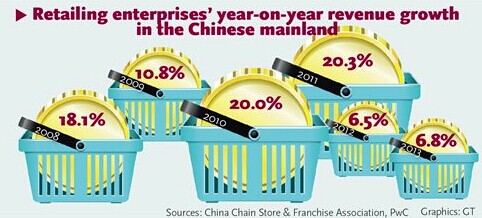

According to the report, which is based on the financial results of 110 China-listed retailers and 29 overseas Fortune 500 retailers between 2008 and 2013, retailers' year-on-year revenue growth dropped to 2.4 percent in the second half of 2013 from 12.3 percent in the first half due to factors like slower economic recovery and lack of consumer incentives.

The retailing industry's operating profit margin fell to 3.9 percent in 2013 from 5.3 percent in 2008, largely due to declining sales, high fixed costs and booming online retailing, said the report.

Some domestic companies have already made a full-year forecast in their latest quarterly financial reports, suggesting lackluster earnings as Wang estimated.

Hong Kong-listed China Resources Enterprise Ltd (CRE), for instance, said in a third-quarter financial report in November that the company's overall profitability may be under significant pressure in the fourth quarter, as it is trying hard to turn around the loss-making Tesco China stores in which CRE snapped up 80 percent from its UK partner in May.

For the nine months through September, CRE's retail division recorded a net loss of HK$2 million ($257,800), down 100.3 percent year-on-year, expecting further losses from China's anti-extravagance policy and fast-growing e-commerce in the fourth quarter, according to the financial report.

Since 2012, when the central government started a campaign against lavish official spending, the use of shopping cards, which hold certain amounts of money, as gifts for officials has kept shrinking.

"Chinese companies, which have fairly low gross profit margin, mainly rely on other venues of gaining profit like offering customers pre-paid shopping cards and charging suppliers for selling goods in their marketplaces," said Jean Sun, another retail specialist with PwC China.

Domestic retailers have already started introducing products, such as jewelry, gold and imported goods, to rake in higher profit margins, reducing reliance on shopping cards.

PwC's report indicated that 11 percent of Chinese retailers' capital are from pre-paid shopping card incomes in 2013, down from 13 percent in 2012.

In comparison to domestic retailers, foreign companies are facing a more difficult time in China, because the latter spend more on management, Yan Qiang, a partner with Beijing Hejun Consulting, told the Global Times Thursday.

Domestic retailers' earlier entry in China's real estate market also saves them from increasing rents, said Yan.

US retailer giant Wal-Mart disclosed in its third-quarter financial report in November that the company has closed 54 underperforming stores in Brazil and China for three months ending in January 31, seeing a 0.8 percent drop year-on-year in China sales for the quarter ending October 31. The company also reportedly cut over 20 mid-level jobs in China as part of its efforts to reduce costs in the market.

Sun told the Global Times Thursday that even though foreign retailers seem to have suffered bumpy localization, they still have some advantages that domestic companies should learn from.

Companies that can make full use of big data, build up a mature logistics chain and maintain high customer loyalty will win in the future, said Sun.

Wang echoed that despite the booming e-commerce, the traditional retail model will not disappear and can stand out through adjustments like innovations in delivery.

Traditional retailers turning from bystanders to participants on Singles Day

2014-11-13No e-commerce: malls to tenants

2013-11-05Asia to become world‘s largest e-commerce market: EIU

2014-12-17Cross-border e-commerce booming

2014-12-01Premier Li pledges government support for e-commerce

2014-11-21E-commerce benefits real economy

2014-11-21Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.