eHi postpones US IPO due to accusation of misrepresenting fleet size, transactions

Chinese car rental company eHi Car Service Ltd has postponed its IPO in the US due to accusations of having provided fake information in its prospectus, which the company denied on Sunday.

The Shanghai-based company planned to get listed on the New York Stock Exchange on Friday but it delayed its IPO to Monday (US time) due to the accusation, the Beijing Youth Daily newspaper reported Sunday.

The accusation of providing fake information is "ungrounded" and hostile, aimed at thwarting the company's listing, according to eHi's statement released Sunday on its Sina Weibo.

The car service provider's independent registered public accounting firm PricewaterhouseCoopers Zhong Tian LLP (PwC) and underwriters received anonymous letters in October and PwC received a similar letter again on November 12, the statement said.

The unidentified author or authors of the letters, claimed to be employees of eHi, and alleged that the company misrepresented financial and operating information in its prospectus.

The accusation alleges that the company misrepresented its fleet size by including cars that were lost or no longer suitable for operating, exaggerated fleet utilization rates by counting lost and idle cars, and recorded fake transactions, according to eHi's update of its prospectus filed to US Securities and Exchange Commission on November 13. The company's prospectus was filed in early October.

As of June 30, eHi has 15,409 cars in total and the average available fleet size is 13,289 cars, which indicates an idle car rate of about 15 percent, according to its prospectus.

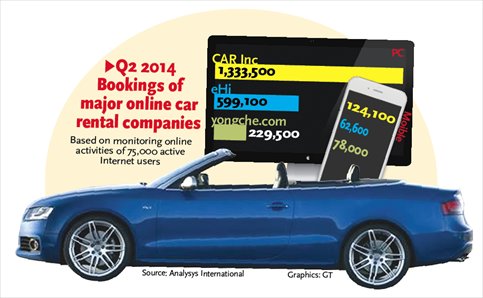

Car service providers usually have an idle car rate of between 20 percent to 30 percent, Zhu Zhengyu, an analyst at Analysys International, a Beijing-based consultancy, told the Global Times Sunday.

Idle cars are vehicles that are not in operation due to reasons such as being repaired or maintenance, he noted.

After PwC received the first letter in October, eHi hired a law firm to run an investigation, which found no evidence for the allegations, the company said in its statement.

Meanwhile, PwC also put eHi's financial report into additional auditing which resulted in no changes to its previous auditing report, according to the statement.

Although eHi has been backed by the investigation result, it still needs to dispel doubts from the market and regulators, Zhao Zhanling, a Beijing-based legal counsel with the Internet Society of China, told the Global Times Sunday, noting it is too early to be able to say how much influence the allegations will have.

Zhu is more optimistic about eHi's future and said that as Chinese people's incomes grow, the market for car service has been expanding quickly, leading to investors' favoring of car service providers such as eHi.

Data from Frost & Sullivan showed that the total market size of China's car rental and car service industry grew from 10.7 billion yuan ($1.75 billion) in 2009 to 29.7 billion yuan in 2013. Frost & Sullivan predicts that the total market of China's car rental and car service industry will continue to grow to 56.3 billion yuan by 2017, according to eHi's prospectus.

eHi started its business in 2006 and became the No.1 car service provider and No.2 car rental provider in China in market share by revenue in 2013, according to eHi's prospectus.

If eHi launches its IPO, it would be the second listed Chinese auto rental company following CAR Inc, which got listed in Hong Kong on September 19.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.