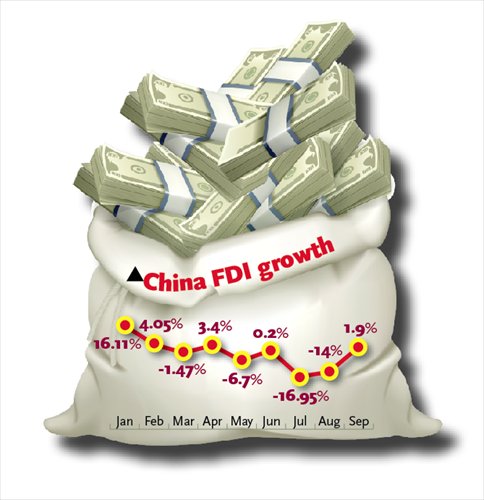

China's foreign direct investment inflows in September reversed the recent downtrend to grow at the fastest pace since April, data from the Ministry of Commerce (MOFCOM) showed Thursday.

The rebound eased concerns about a sharper slowdown, despite the year-to-date FDI figure staying in the negative territory.

In September, China attracted $9.01 billion in foreign direct investment (FDI), up 1.9 percent from a year earlier, according to MOFCOM data released at a press conference.

The year-on-year growth in September rebounded from a 14 percent plunge in August and 17 percent drop in July.

In the first nine months, FDI totaled $87.36 billion, down 1.4 percent compared with the same period of 2013.

"We expect China's FDI to maintain its stable path this year if there are no big fluctuations in the global and domestic conditions," said Shen Danyang, MOFCOM's spokesman.

FDI from South Korea and the UK grew 32.5 percent and 32.3 percent in the first nine months compared with the same period of 2013, while investment from other major economies including the European Union (EU), US and Japan witnessed year-on-year declines of 18.8, 24.7 and 43 percent respectively.

"We have been confident on China's attraction for FDI," Shen said, dismissing market concerns about an investment stall as the economy slows.

Despite the improvement in September, the FDI prospects are not optimistic, as major economies are withholding their decision to invest in China, He Weiwen, co-director of the China-US-EU Study Center under the China Association of International Trade, told the Global Times on Thursday.

"It is still necessary for China to receive FDI as it brings advanced technologies, management experience and multinational companies with rich capital and market sources," He said.

The FDI decline in the first three quarters was caused by economic slowdown, anti-corruption campaign, extensive antitrust probes, as well as rising competitiveness of Chinese firms, which drove away some potential foreign investors, according to Mei Xinyu, a research fellow at the Chinese Academy of International Trade and Economic Cooperation.

"China's economy is going through a deeper restructuring and the Sino-EU and Sino-US investment treaties are yet to be finalized, which are creating uncertainties for foreign investors," Mei told the Global Times in a note on Thursday.

With China's reform efforts set to open its door wider, the FDI is expected to bounce back, Mei wrote.

Meanwhile, China's non-financial outbound investment surged 90.5 percent to $9.79 billion in September, taking the total for the January-September period to $74.96 billion.

Hong Kong, ASEAN, EU, US and Russia are among the top destinations for Chinese firms' investment.

"Outbound investment is only at a preliminary stage of expansion, and it is possible that investment outflows even surpass inflows this year if they grow faster in the fourth quarter," said China-US-EU Study Center's He.

FDI and outbound investment are important measures of the health of the domestic and global economies, but they are smaller contributors to China's economy compared with exports.

China's exports in September were unexpectedly strong with a 15.3 percent year-on-year growth, the highest since February 2013, while imports rose 7 percent, also beating expectations.

The strong export growth in September was normal, but the MOFCOM has noticed that exports of some products from some regions to Hong Kong grew too fast in September, which the ministry said it will closely monitor.

Apart from exports, consumption also expanded steadily, the MOFCOM data showed. Sales revenues of 5,000 large retailers nationwide tracked by the ministry grew by 6.3 percent in the first three quarters, mainly fueled by e-commerce.

Sales of major e-commerce retailers soared 44 percent in September, leading to an overall expansion of e-commerce retail sales by 32.2 percent in the first nine months from a year earlier, the MOFCOM said.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.