Move aimed at easing funding woes of SMEs

Bank of Suzhou, a local joint stock commercial bank in East China's Jiangsu Province, announced Monday that it is setting up a peer-to-peer (P2P) lending business division with technological support from dianrong.com, a Shanghai-based P2P lending website.

Experts say the alliance between the bank and the P2P lending website, the first of its kind, is a good attempt to improve lending services for small and micro-sized companies, despite of some risks.

Wang Lanfeng, chairwoman of Suzhou Bank, was quoted by news portal qq.com on Monday as saying that she hoped the move, backed by Internet-based technologies, could better address the largely unattended financing needs of China's small and micro-sized companies.

Online P2P lending service links micro-credit lenders and borrowers, allowing global donors to lend money to Chinese individuals. This financing model received warm reception among small and micro-sized enterprises too weak to get loans from banks.

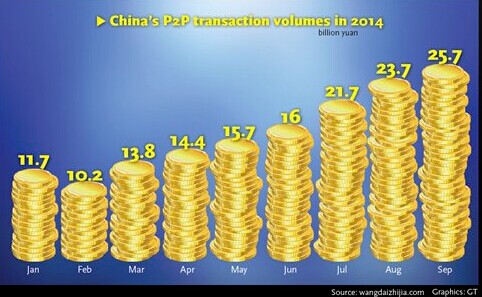

In September, China's P2P lending platforms handled 25.7 billion yuan ($3.87 billion), up 8.71 percent from August, showed data from Shanghai-based P2P industry information provider wangdaizhijia.com.

Chen Guohui, an analyst with P2P information portal p2peye.com, told the Global Times Monday that P2P lending services will see strong growth.

"P2P lending, originally devised to fund individual borrowers, now aims to expand market share by opening a new front for small and micro-sized enterprises," Chen said.

Experts said small and micro-sized companies, without much credit rating, have long been forced to borrow from loan sharks and other channels to get much-needed operational funds.

"The P2P platform is a fully competitive market, with a great number of participants, and this means small companies can fetch a fairer rate for the credit," Chen said.

Wang believed that different from large banks, providing financial services to small and micro-sized companies is a new growth point for the city-based commercial banks in China.

According to its website, Suzhou Bank has over 120 branches in cities in the Yangtze River Delta, home to hundreds of thousands of small and micro-sized companies.

The initiative by Suzhou Bank and dianrong.com may become a future trend, in which P2P lending companies move one step closer to the golden key to tap the cheap capital deposited in banks, a Beijing-based P2P insider, who declined to be named, told the Global Times Monday.

"Large banks still remain un-impressed by the business operated by P2P firms, as the overall volume of P2P business is still negligible. However, they may be forced to take note as more innovative P2P firms compete for depositors," Chen said.

A number of Chinese banks, such as China Merchants Bank and Ping An Bank, have already rolled out small-scale loans with lower interest rates via the instruments of P2P platforms to attract customers.

Experts say many of China's P2P platforms have weak risk management and the industry as a whole lacks regulation, with no threshold and industry standards.

"Risk management could be vital in this marriage. Banks are more sensitive to risks, while the risk management capacity of a large number of P2P firms is far from the level acceptable to banks. When problems occur, banks would renounce their marriage vow," the insider said.

A report released Saturday by the Chinese Academy of Social Sciences (CASS) pointed out that there were 74 cases on record in which the P2P platforms experienced operational difficulties, closures, and cases in which their executives escaped from liabilities in 2013.

The number of problem-stricken P2P lending firms accounted for about 11 percent of the total. And the number of meltdowns in 2013 was three times higher than the figure recorded in previous years, the CASS report shows. As of Monday, there are 1,438 P2P lending platforms in China, 22 of which experienced difficulties in September, according to wangdaizhijia.com.

"Dianrong could benefit from the cooperation in terms of possible data sharing with banks. What's more important, the endorsement of a bank will serve as a driving force for the company to promote its products and expand its investor pool," Chen said.

Traditional lenders feel the heat as P2P firms gain ground

2014-09-23CRAs pose risks to P2P lending sites

2014-09-22China’s P2P lending shows both growth and risk

2014-08-28Time to clean up P2P loan websites

2014-08-15New rules coming for China‘s P2P lending companies

2014-08-04New rules coming for China‘s P2P lending companies

2014-07-21Tighter rules may hit rise in P2P loans

2014-05-15Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.