China's service sector will attract more foreign direct investment than other industries over the next decade, according to a report released on Friday.

The 2014 Report on Foreign Investment in China said the development will come as the government opens more market channels for international companies to seek new growth points.

The annual report by the University of International Business and Economics in Beijing said investment on the Chinese mainland by Taiwan dropped by 27 percent year-on-year in 2013.

This indicates that global market demand is changing, and companies in Taiwan are adjusting their industrial development structures, the report said.

Japanese investment in China fell by 4 percent year-on-year as Japan increasingly sought to direct its resources outside China to fuel growth.

Ma Yu, a senior researcher at the Chinese Academy of International Trade and Economic Cooperation, said companies in Japan and Taiwan have found that gaining market share on the Chinese mainland is no longer as easy as it once was.

"Local companies today are quite aggressive in seizing the market after acquiring various technologies through years of development and international cooperation," Ma said.

"Companies from the United States and Europe, eager to diversify their investments, have looked to China's service sector, especially the service outsourcing business."

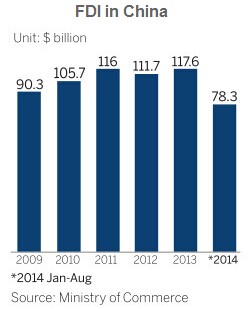

Foreign direct investment, or FDI, in China reached $117.59 billion in 2013, with service-sector investment rising by 14.15 percent year-on-year to $61.45 billion.

FDI in the manufacturing sector dropped by 6.78 percent to $45.56 billion, according to the Ministry of Commerce.

Service industry areas such as finance, education, healthcare, architectural design, accounting, auditing, commercial logistics and e-commerce will become pillar industries in attracting FDI over the next 10 years, the report said.

Efforts have been made to open up many service sectors by governments at all levels. Foreign companies will be allowed to establish joint venture hospitals with local partners in 2015, while investment from Hong Kong and Macao can be used to run hospitals independently in selected Chinese cities starting next year.

Wang Zhile, a senior foreign investment researcher at the Chinese Academy of International Trade and Economic Cooperation, said China's steel, solar panel, shipbuilding and coal chemical industries are confronting overcapacity, environmental protection laws, backward technologies and low profits.

"As a result, the manufacturing industry's ability to attract FDI will continue to drop this year," Wang said.

The report said investment by foreign companies will switch from eastern areas of China to central regions in the next five to 10 years, where it can reach more domestic markets with developed transportation and a solid industrial foundation.

Zhang Shixian, a researcher at the Institute of Industrial Economics at the Chinese Academy of Social Sciences, said FDI in China had previously been attracted by low-cost labor and manufacturing. Investors are becoming more sensitive about China's move to cut the proportion of labor-intensive industries and low-value-added products.

In the long term, FDI in China will be motivated by a strong desire to seize market share by eliminating rivals and competing with local companies head-to-head, Zhang said.

Services sector remains robust in September

2014-10-09Services growth hits 8-month low

2014-10-04Weaker service activity ends rally

2014-10-09FDI dips for 2nd straight month

2014-09-17China FDI inflows continue to drop in Aug

2014-09-16FDI fall not caused by antitrust probes

2014-08-20Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.